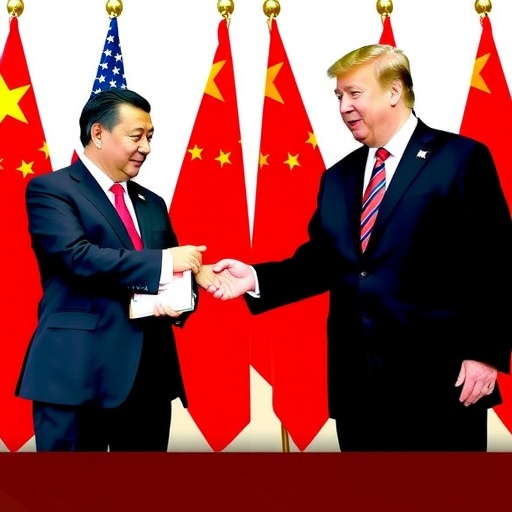

US and China Finalize Sweeping Trade Deal Ahead of High-Stakes Trump-Xi Summit

In a move that could redefine global economic landscapes, the United States and China are on the verge of announcing a comprehensive trade deal just days before a pivotal summit between President Donald Trump and Chinese President Xi Jinping. Sources close to the negotiations reveal that the agreement addresses long-standing disputes over tariffs, intellectual property rights, and market access, potentially easing tensions that have plagued US-China trade for years.

The breakthrough comes after months of intense back-channel talks, with diplomats from both sides reporting progress on core issues. This development marks a significant shift in the often volatile relationship between the world’s two largest economies, promising relief for businesses battered by escalating trade wars. As the Trump-Xi summit approaches in Washington, D.C., expectations are high that the leaders will seal the deal, injecting stability into international markets.

Breaking Down the Core Elements of the US-China trade Deal

At the heart of the emerging trade deal lies a series of concessions designed to balance the scales in US-China trade. US negotiators have pushed hard for China to reduce its non-tariff barriers, including subsidies to state-owned enterprises that have long irked American industries. In return, the US is prepared to lift retaliatory tariffs imposed during the Trump administration’s aggressive trade stance.

Key provisions include China’s commitment to purchase an additional $200 billion worth of American agricultural products over the next two years, a boon for Midwest farmers who have suffered from export losses. Intellectual property protections are another cornerstone, with Beijing agreeing to stricter enforcement against theft and counterfeiting, issues that the US Trade Representative’s office estimates cost American firms up to $600 billion annually.

“This deal represents a pragmatic step forward,” said Robert Lighthizer, the US Trade Representative, in a recent briefing. “It safeguards American innovation while opening doors for fair competition.” On the Chinese side, officials emphasize reciprocity, noting that the agreement will allow greater access for Chinese tech firms to the US market, potentially leveling the playing field in sectors like telecommunications and renewable energy.

Statistics underscore the stakes: Bilateral trade volume reached $690 billion in 2022, but tariffs have shaved off an estimated 0.5% from global GDP growth, according to the International Monetary Fund. By resolving these frictions, the deal could unlock $100 billion in new trade opportunities, analysts predict.

Trump’s Bold Tactics Shape US-China Trade Negotiations

President Trump’s unorthodox approach to diplomacy has been instrumental in driving the US-China trade negotiations to this critical juncture. From his first term, Trump adopted a “maximum pressure” strategy, imposing tariffs on $360 billion of Chinese goods to force concessions. Critics dubbed it a gamble, but supporters credit it with extracting promises from Beijing that previous administrations couldn’t secure.

Recent leaks from the White House suggest Trump plans to leverage the summit for personal optics, framing the trade deal as a victory for his “America First” agenda. In a tweet last week, Trump boasted, “Big progress with China—deals like this make America great again!” His direct style has resonated in negotiations, where US teams have used data-driven arguments to highlight the asymmetry in trade deficits, which stood at $355 billion in favor of China last year.

Yet, Trump’s tactics haven’t been without controversy. Labor unions worry that eased restrictions could flood the US market with cheap imports, displacing domestic manufacturing jobs. The United Auto Workers, for instance, has lobbied for safeguards, citing a loss of 200,000 jobs since the trade war began. Despite these concerns, Trump’s administration argues the deal includes mechanisms for monitoring compliance, such as joint oversight committees to prevent dumping practices.

Looking at historical context, Trump’s negotiations build on the Phase One deal signed in 2020, which China partially fulfilled by buying $124 billion in US goods—short of the $200 billion target. This time, enforceable penalties for non-compliance are baked in, a concession Trump has touted as his signature achievement.

Xi Jinping’s Vision Guides China’s Stance in Trade Talks

President Xi Jinping’s leadership has been equally pivotal, steering China toward a more conciliatory posture in US-China trade discussions. Xi’s “Dual Circulation” economic strategy, which emphasizes domestic consumption while pursuing global integration, has allowed Beijing to approach the negotiations with confidence. By diversifying away from over-reliance on US markets, China has strengthened its bargaining position.

In a speech to the National People’s Congress earlier this year, Xi stated, “We seek win-win cooperation with the United States, fostering mutual respect and shared prosperity.” This rhetoric signals a departure from earlier defensiveness, as China grapples with its own economic slowdown, including a 5.2% GDP growth rate in 2023 hampered by property sector woes and youth unemployment at 15%.

Chinese negotiators have focused on securing commitments from the US to ease export controls on high-tech goods, vital for China’s semiconductor ambitions. The deal reportedly includes provisions for joint ventures in electric vehicles, where China’s BYD and US firms like Tesla could collaborate, potentially creating 50,000 jobs across both nations.

Experts note Xi’s personal stake in the outcome: A successful summit bolsters his image as a global statesman amid domestic challenges. However, hardliners in Beijing caution against over-concession, fearing it could undermine China’s technological self-reliance goals outlined in the Made in China 2025 initiative.

Global Markets Brace for Ripples from the Trump-Xi Trade Breakthrough

The anticipated US-China trade deal is sending shockwaves through global markets, with investors anticipating a surge in cross-border investments. Stock indices in Asia rose 2% following rumors of the agreement, while Wall Street futures pointed to gains in tech and manufacturing sectors heavily exposed to US-China trade.

Economists forecast that resolving the trade impasse could add 0.3% to US GDP growth in 2024, per a Moody’s Analytics report. For China, it means stabilized supply chains, crucial as it exports 20% of its goods to the US. Multinational corporations like Apple and Boeing stand to benefit immensely; Apple, which assembles iPhones in China, could save $5 billion in tariffs annually.

However, not all effects are positive. European Union officials express concern that a US-China pact might sideline them, prompting calls for a trilateral framework. In developing nations, commodity exporters like Brazil could see boosted demand for soybeans and iron ore, commodities central to the deal’s agricultural and infrastructure components.

Environmental advocates highlight a silver lining: The agreement includes green trade clauses, promoting sustainable practices in solar panel and battery production, aligning with global climate goals. Quotes from market watchers abound; Jamie Dimon, CEO of JPMorgan Chase, remarked, “This deal could be the reset button international trade needs post-pandemic.”

Outlook for the Trump-Xi Summit and Beyond

As the Trump-Xi summit looms, both leaders are poised to announce the trade deal in a joint press conference, symbolizing a thaw in relations strained by issues like Taiwan and human rights. Diplomatic preparations include side meetings on cybersecurity and climate cooperation, broadening the agenda beyond economics.

Implementation will be key, with a phased rollout over 18 months monitored by an independent bilateral commission. If successful, it could pave the way for deeper integration, such as a free trade area in the Asia-Pacific. Challenges remain, including congressional approval in the US and internal ratification in China, but optimism prevails.

Looking ahead, this trade deal might herald a new era of strategic partnership, mitigating risks of decoupling between the superpowers. For businesses and consumers worldwide, the implications are profound: lower prices, innovation boosts, and a more predictable global economy. As Trump and Xi prepare to meet, the world watches closely for signals of enduring peace in US-China trade.