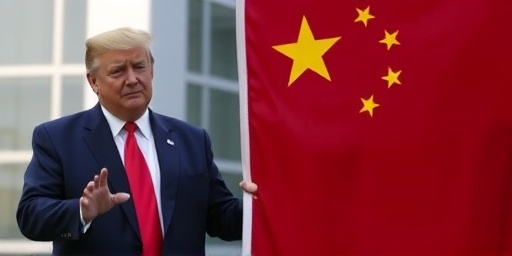

In a bold move signaling a aggressive stance on international trade, President-elect Donald Trump’s transition team has unveiled plans to impose 60% Tariffs on a wide range of Chinese imports upon taking office. This announcement, made during a high-level briefing in Washington D.C., has sent shockwaves through global markets, reigniting fears of a full-blown trade war between the world’s two largest economies. Economists are already warning of severe repercussions, including sharp spikes in inflation and widespread disruptions to supply chains that underpin everything from consumer electronics to everyday apparel.

The proposed Tariffs target key sectors such as technology, manufacturing, and consumer goods, aiming to protect American jobs and reduce the U.S. trade deficit with China, which stood at $367 billion in 2023 according to U.S. Census Bureau data. Trump’s team argues that these measures will revitalize the Trump economy by encouraging domestic production and curbing what they describe as unfair trade practices by Beijing. However, critics contend that the policy could backfire, driving up costs for American consumers and businesses alike.

Trump’s Tariff Strategy Targets Core Chinese Exports

At the heart of the announcement is a comprehensive tariff framework designed to hit China’s export-heavy industries hardest. Officials from the incoming administration detailed that the 60% levy would apply to electronics, machinery, textiles, and chemicals—categories that accounted for over 70% of China’s $500 billion in exports to the U.S. last year, per World Trade Organization figures. This escalation builds on Tariffs imposed during Trump’s first term, which ranged from 10% to 25%, but represents a dramatic intensification.

‘These tariffs are not punitive; they are protective,’ stated incoming Commerce Secretary nominee Robert Lighthizer, echoing his role in the 2018 trade disputes. Lighthizer emphasized that the policy aligns with Trump’s ‘America First’ agenda, projecting that it could create up to 2 million manufacturing jobs over the next four years, based on internal economic modeling. Yet, the scope is broad: smartphones from companies like Huawei and Xiaomi could see price hikes of 40-50%, while apparel from fast-fashion giants might increase by 30%, according to preliminary estimates from the Peterson Institute for International Economics.

The strategy also includes exemptions for critical minerals needed for U.S. green energy initiatives, a nod to balancing trade protectionism with national security and environmental goals. However, the overall plan has drawn immediate pushback from U.S. importers, who warn that front-loading these costs could strain an already fragile post-pandemic recovery.

Economists Predict Inflation Surge from New China Trade Barriers

As news of the tariffs spread, economists across the spectrum voiced grave concerns about their inflationary impact on the Trump economy. The Federal Reserve’s preferred gauge of inflation, the Personal Consumption Expenditures (PCE) index, could climb by 1.5 to 2 percentage points within the first year of implementation, according to a report from Moody’s Analytics released just hours after the announcement. This would exacerbate current pressures, where core inflation hovers around 3.2% as of late 2024.

‘Tariffs are essentially a tax on imports, and in this case, they’ll be passed directly to consumers,’ warned Harvard economist Kenneth Rogoff in an interview with Bloomberg. Rogoff highlighted that during the 2018-2019 trade skirmishes, U.S. household spending rose by an average of $1,277 annually due to higher prices on tariffed goods. With the new 60% rate, that figure could double, hitting low-income families hardest as essentials like toys, furniture, and clothing become pricier.

Broader economic models from the IMF suggest that sustained tariffs could shave 0.5% off U.S. GDP growth in 2025, while inflating import costs by $200 billion. The keywords ‘inflation’ and ‘tariffs’ are already trending on financial forums, with investors bracing for volatility. Federal Reserve Chair Jerome Powell, in a recent statement, noted that while the central bank remains vigilant, such policies could complicate efforts to stabilize prices without stifling growth.

- Key Inflation Drivers: Higher costs for intermediate goods used in U.S. manufacturing, leading to a ripple effect across industries.

- Sector-Specific Hits: Automotive parts from China, vital for 40% of U.S. vehicle production, could add $1,000 to the average car price.

- Consumer Impact: Grocery items indirectly affected via packaging and machinery tariffs might see a 5-10% uptick.

Despite these warnings, Trump supporters point to historical precedents, arguing that short-term pain will yield long-term gains in reducing reliance on foreign supply chains.

Supply Chain Disruptions Threaten Global Manufacturing Hubs

Beyond inflation, the tariffs pose a existential threat to intricate global supply chains intertwined with China trade. Multinational corporations like Apple, Nike, and General Motors, which source 20-30% of their components from China, are scrambling to assess the fallout. A survey by the U.S. Chamber of Commerce revealed that 65% of member companies anticipate delays in production timelines, potentially halting assembly lines in states like Michigan and California.

The disruptions could be felt acutely in semiconductors and rare earth minerals, where China controls 80% of global supply, per U.S. Geological Survey data. ‘We’re looking at a reconfiguration of supply chains that could take years and billions in investments,’ said Deloitte supply chain expert Maria Martinez during a CNBC panel. Companies are eyeing alternatives in Vietnam, Mexico, and India, but scaling up there won’t happen overnight—experts estimate a 2-3 year lag before meaningful diversification.

In the short term, stockpiling has already begun, with U.S. ports reporting a 15% increase in Chinese imports in Q4 2024 as businesses front-load shipments. This rush risks port congestion reminiscent of the 2021 supply crunch, which cost the economy $160 billion. For the Trump economy, these bottlenecks could undermine promises of efficiency and growth, particularly in export-dependent sectors like agriculture, where retaliatory tariffs from China might target soybeans and pork, costing farmers $10 billion annually based on past patterns.

- Immediate Actions: Firms accelerating reshoring, with 25% planning U.S. expansions per a KPMG study.

- Long-Term Shifts: Potential for ‘friend-shoring’ to allies, boosting trade with Canada and the EU.

- Risk Mitigation: Governments considering subsidies to offset tariff costs, though fiscal hawks warn of ballooning deficits.

The interplay of tariffs and supply chains underscores the high stakes, as any misstep could cascade into a broader economic slowdown.

Business Leaders and Beijing React to Tariff Escalation

The business community has been vocal in its response, with a mix of apprehension and cautious optimism. The National Association of Manufacturers (NAM) issued a statement calling for ‘targeted protections rather than blanket tariffs,’ citing surveys where 72% of members fear job losses from higher input costs. Tech giant Intel’s CEO Pat Gelsinger tweeted, ‘While we support fair trade, these measures must not hinder innovation—China’s dominance in chips is a security issue, but so is affordability for Americans.’

From Beijing’s perspective, the announcement has elicited sharp condemnation. Chinese Foreign Ministry spokesperson Wang Wenbin declared, ‘Such unilateral actions violate WTO rules and will harm global stability,’ vowing retaliatory measures on U.S. exports like aircraft and agricultural products. China, which has diversified its markets to Europe and ASEAN nations, exported $3.6 trillion in goods last year and shows no signs of backing down. Analysts from the Brookings Institution predict that Beijing might accelerate its ‘dual circulation’ strategy, focusing on domestic consumption to weather the storm.

U.S. allies are watching closely too. The European Union, facing its own China trade imbalances, expressed support for multilateral solutions over unilateral tariffs, with Trade Commissioner Valdis Dombrovskis stating, ‘We stand ready to collaborate with the U.S. on fair competition frameworks.’ This could open doors for trilateral talks, potentially softening the edges of a renewed trade war.

Retailers like Walmart and Target, heavily reliant on Chinese sourcing, have already signaled price adjustments, with Walmart’s CFO warning of a 5% overall increase in merchandise costs. Small businesses, however, may fare worse, lacking the bargaining power to absorb hits— the Small Business Administration estimates 40% could see profit margins shrink by 15%.

Outlook for US-China Relations Amid Tariff Tensions

Looking ahead, the tariffs could redefine the contours of the Trump economy and global trade dynamics. Implementation is slated for the first 100 days of the administration, with congressional hearings expected to debate exemptions and enforcement mechanisms. If passed, the policy might spur negotiations, as seen in the Phase One deal of 2020, where China committed to $200 billion in U.S. purchases—though compliance fell short at 60%, per U.S. Trade Representative reports.

Optimists within Trump’s circle envision a stronger dollar and revitalized Rust Belt industries, potentially adding 1-2% to annual GDP through onshoring. Pessimists, including Nobel laureate Paul Krugman, foresee stagflation risks, where inflation rises alongside slowing growth, reminiscent of the 1970s. Market watchers predict volatility in the S&P 500, with initial dips of 3-5% possible as investors price in uncertainty.

Geopolitically, the move aligns with broader efforts to counter China’s influence, including alliances like the Quad and AUKUS. Yet, it risks alienating developing nations dependent on Chinese investment via the Belt and Road Initiative. As the world awaits inauguration day, stakeholders from Wall Street to Main Street are preparing for a turbulent chapter in China trade relations, with inflation and tariffs at the forefront of economic debates. Policymakers will need to navigate these waters carefully to avoid derailing the recovery and fostering sustainable growth.