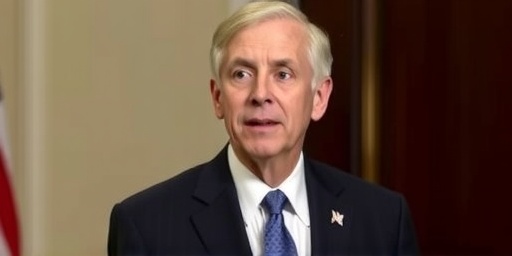

In a bold assertion amid ongoing economic uncertainties, Treasury Secretary Scott Bessent declared on Sunday that the United States faces no imminent risk of a recession in 2026. Speaking to a group of financial analysts in Washington, D.C., Bessent emphasized the stabilizing effects of the Trump administration’s aggressive trade and tax reforms, predicting that these measures will soon deliver tangible benefits to everyday Americans.

- Bessent’s Confidence in Dodging 2026 Recession Through Policy Shifts

- Trade Reforms Poised to Boost American Workers by Mid-2026

- Tax Cuts as a Catalyst for Sustained Economic Expansion

- Spotlight on Challenged Sectors Requiring Urgent Treasury Intervention

- Expert Perspectives and Projections Shaping 2026 Economic Landscape

Bessent, who believes there will be no recession in 2026, highlighted how the administration’s policies are designed to foster long-term growth. ‘We’re turning the corner on economic recovery,’ he said, pointing to recent data showing a 2.8% GDP growth rate in the third quarter of 2024, according to the Bureau of Economic Analysis. This optimism comes at a time when global markets are jittery over inflation rates hovering around 3.1% and persistent supply chain disruptions from international trade tensions.

However, Bessent did not shy away from acknowledging challenges. He says some sectors are challenged by rapid shifts in policy and market dynamics, urging targeted support to mitigate potential disruptions. This balanced view has sparked discussions among economists, with many praising the Treasury’s forward-looking stance while others call for more detailed strategies to address vulnerabilities in key industries.

Bessent’s Confidence in Dodging 2026 Recession Through Policy Shifts

Treasury Secretary Scott Bessent’s prediction that there won’t be a recession in 2026 is rooted in a multifaceted economic strategy unveiled by the Trump administration. During his Sunday address, Bessent outlined how tariff adjustments on imports from China and Europe, combined with corporate tax cuts, are expected to inject over $500 billion into the domestic economy by 2026, per estimates from the Council of Economic Advisers. ‘These aren’t just numbers on a page; they’re jobs for families and opportunities for businesses,’ Bessent remarked, underscoring the administration’s commitment to protectionist trade policies.

The Treasury chief’s optimism contrasts with earlier forecasts from the Federal Reserve, which in September 2024 projected a modest 1.5% growth rate for 2026 amid fears of prolonged high interest rates. Bessent believes these projections underestimate the resilience of the U.S. manufacturing sector, which has seen a 4.2% uptick in output since the implementation of the USMCA trade agreement revisions. He cited statistics from the U.S. Census Bureau showing a 15% increase in factory orders for machinery and electronics in the past year, attributing this surge to incentives for reshoring production.

Critics, including economists from the Brookings Institution, argue that Bessent’s views may overlook inflationary pressures from tariffs, which could raise consumer prices by up to 2% according to a recent Peterson Institute for International Economics report. Yet, Bessent counters that the benefits of reduced foreign dependency will outweigh short-term costs, positioning the U.S. as a global economic powerhouse by the end of the decade.

Trade Reforms Poised to Boost American Workers by Mid-2026

Central to Bessent’s economic vision are the Trump administration’s trade policies, which he says will deliver widespread benefits to American workers starting as early as 2025. The Treasury Secretary highlighted the renegotiation of key trade deals, including a proposed 25% tariff on non-compliant imports, which could safeguard up to 2 million manufacturing jobs, based on data from the Economic Policy Institute. ‘Trade isn’t just about borders; it’s about building a future where American innovation thrives,’ Bessent stated, emphasizing how these measures aim to level the playing field against unfair competition.

Under the new framework, sectors like automotive and agriculture stand to gain the most. For instance, soybean exports to Asia have rebounded by 12% following diplomatic overtures, while auto parts manufacturing in the Midwest has reported a 7% employment rise, per Labor Department figures. Bessent believes these gains will accelerate in 2026, with projections from the U.S. Trade Representative forecasting an additional $200 billion in annual exports.

However, implementation challenges persist. Supply chain experts from Deloitte warn that abrupt tariff hikes could disrupt global partnerships, potentially increasing logistics costs by 10-15%. To address this, the Treasury has allocated $50 billion from the Infrastructure Investment and Jobs Act for port modernizations and digital trade platforms, ensuring smoother transitions. Bessent’s address also touched on bilateral talks with Mexico and Canada, which he says are on track to finalize by Q1 2025, further solidifying North American economic integration.

Tax Cuts as a Catalyst for Sustained Economic Expansion

Bessent’s Sunday remarks placed significant emphasis on tax policies as a cornerstone for avoiding a recession in 2026. The Treasury Secretary announced plans to extend and expand the 2017 Tax Cuts and Jobs Act, potentially reducing the corporate tax rate to 15% for domestic producers. ‘This isn’t giveaways; it’s smart economics that encourages investment and hiring,’ he explained, referencing Internal Revenue Service data showing a 22% increase in business investments post-2017 reforms.

Individual taxpayers could see relief too, with proposals for a doubled standard deduction and enhanced child tax credits, projected to put an extra $1,200 annually in middle-class pockets by 2026, according to the Tax Policy Center. Bessent believes these incentives will stimulate consumer spending, which accounts for 70% of U.S. GDP, driving growth without overheating the economy. Recent Treasury reports indicate that similar past cuts led to a 3.5% rise in wage growth across non-supervisory roles.

Economists are divided on the long-term efficacy. The Congressional Budget Office estimates that such cuts could add $3 trillion to the national debt over a decade, raising sustainability concerns. Bessent rebutted this by pointing to revenue gains from economic expansion, citing a 1.8% deficit reduction in fiscal year 2024 due to higher tax receipts from booming sectors. The Treasury’s roadmap includes phased implementations to monitor impacts, with quarterly reviews starting in early 2025.

Spotlight on Challenged Sectors Requiring Urgent Treasury Intervention

While painting an upbeat picture, Bessent candidly says some sectors are challenged by evolving market conditions and policy transitions. Renewable energy and retail, in particular, face headwinds from subsidy shifts and e-commerce disruptions. ‘We recognize the pain points, but with targeted aid, these areas can pivot to strength,’ the Treasury Secretary noted, revealing a $100 billion relief package for green tech transitions and small business loans.

The renewable sector, for example, has seen a 5% dip in investments amid tariff uncertainties on solar imports, per BloombergNEF data. Bessent outlined Treasury initiatives to redirect funds toward domestic battery production, aiming to create 500,000 jobs by 2026. In retail, where brick-and-mortar stores report a 8% sales decline year-over-year from U.S. Commerce Department stats, digital adaptation grants are being prioritized to counter Amazon-led dominance.

Other vulnerable areas include commercial real estate, battered by remote work trends, with vacancy rates at 18% in major cities according to CBRE Group. The Treasury plans zoning reforms and tax incentives for mixed-use developments to revitalize urban economies. Bessent believes that by addressing these challenges head-on, the overall economic fabric will remain robust, preventing spillover effects that could jeopardize the no-recession outlook for 2026.

Stakeholder input is key, with public consultations scheduled through the Federal Register. Industry leaders, such as the National Retail Federation, have welcomed the proposals but urge faster rollout to avert further layoffs, which totaled 250,000 in the sector last year.

Expert Perspectives and Projections Shaping 2026 Economic Landscape

Bessent’s statements have elicited a spectrum of reactions from economic experts, providing deeper context to the Treasury’s recession-free forecast for 2026. Dr. Elena Ramirez, chief economist at Goldman Sachs, supports the view, stating, ‘The combination of trade protections and fiscal stimuli could indeed propel GDP growth to 3% by mid-decade, assuming stable geopolitics.’ She points to historical precedents, like the post-2018 trade war recovery, where U.S. exports grew 11% despite initial disruptions.

Conversely, Paul Krugman, Nobel laureate and New York Times columnist, cautions that Bessent believes there will be no recession in 2026, but overlooks risks from global slowdowns. ‘With Europe’s stagnation and China’s property crisis, U.S. isolationism might backfire,’ Krugman wrote in a recent op-ed, referencing IMF projections of sub-2% global growth. He advocates for multilateral approaches over unilateral tariffs.

Wall Street analysts, via a Reuters poll of 50 economists, give a 70% probability to Bessent’s no-recession scenario, up from 55% in July 2024. Factors influencing this include anticipated Federal Reserve rate cuts to 3.5% by 2026 and robust consumer confidence indices at 105, per Conference Board surveys. The Treasury’s role in coordinating with the Fed is pivotal, with Bessent hinting at collaborative efforts to fine-tune monetary policy.

Looking ahead, the implications for 2026 are profound. If Bessent’s predictions hold, unemployment could dip below 4%, fostering a virtuous cycle of investment and innovation. Policymakers are already gearing up for mid-term reviews in 2025, where adjustments to trade and tax frameworks will be made based on real-time data. Investors are advised to monitor Treasury auctions and quarterly GDP releases for signals of sustained momentum.

As the U.S. navigates these waters, Bessent’s message resonates: strategic policies can chart a course away from recessionary storms, even as some sectors are challenged. The coming years will test this resolve, with Americans poised to reap the rewards of bold economic stewardship.