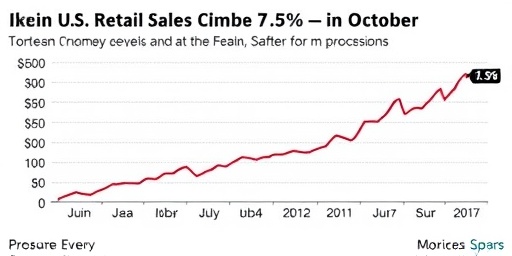

In a welcome boost to the US economy, Retail sales surged by 0.5% in October, outpacing economists’ predictions of a more modest 0.3% increase. This resilient uptick in consumer spending underscores the strength of American households even as high interest rates continue to weigh on borrowing costs and inflation lingers above target levels. The data, released by the US Census Bureau, paints a picture of cautious optimism, helping to temper growing recession fears that have shadowed markets in recent months.

The advance comes after a revised 0.4% gain in September, bringing the year-to-date growth in Retail sales to a solid 3.2%. Excluding volatile categories like autos and gasoline, core Retail sales still rose 0.4%, signaling broad-based consumer activity. This performance is particularly notable given the Federal Reserve’s aggressive rate-hiking campaign, which has pushed the benchmark interest rate to between 5.25% and 5.5%—the highest in over two decades.

Key Retail Sectors Fuel October’s Growth Surge

Delving into the numbers, several retail sectors propelled the overall increase in retail sales. General merchandise stores led the charge with a robust 1.2% jump, driven by seasonal promotions and back-to-school carryover demand. Online retailers also shone, posting a 1.1% rise as e-commerce platforms like Amazon and Walmart capitalized on digital convenience amid busy fall schedules.

Food services and drinking places, encompassing restaurants and bars, saw a 0.8% increase, reflecting consumers’ willingness to splurge on experiences despite tighter budgets. Health and personal care stores contributed with a steady 0.6% gain, bolstered by ongoing demand for wellness products. However, not all sectors fared equally; furniture and home furnishings dipped 0.3%, likely due to high mortgage rates deterring big-ticket purchases like appliances and renovations.

Gasoline stations experienced a slight 0.2% decline as pump prices stabilized after summer peaks, but this was offset by strength in sporting goods, hobby, and book stores, which climbed 1.5% on holiday prep and outdoor activity trends. Electronics and appliance retailers held flat at 0%, hampered by elevated prices for gadgets amid supply chain normalization.

- General merchandise: +1.2%

- Online sales: +1.1%

- Food services: +0.8%

- Sporting goods: +1.5%

- Furniture: -0.3%

These sector-specific insights highlight how diversified consumer spending patterns are supporting the economy’s soft landing narrative. Retail analysts point to strategic discounting and loyalty programs as key factors encouraging spending without eroding profit margins for merchants.

Consumer Spending Holds Firm Against Interest Rate Headwinds

At the heart of October’s retail sales data is the enduring resilience of consumer spending, which accounts for nearly 70% of US gross domestic product. Despite the Fed’s rate hikes aimed at curbing inflation, households have tapped into savings accumulated during the pandemic and wage gains from a tight labor market. The unemployment rate remains low at 3.8%, and average hourly earnings rose 4.1% year-over-year in October, outpacing inflation’s 3.2% clip.

Yet, challenges persist. Credit card delinquency rates have ticked up to 3.1% from 3.0% in the prior quarter, according to Federal Reserve data, signaling that some lower-income consumers are stretching finances thin. High-interest auto loans, averaging 7.5%, have also slowed big purchases, with new vehicle sales flatlining at 0.1% growth for the month.

“Consumers are proving more adaptable than expected,” said Dr. Elena Ramirez, chief economist at the National Retail Federation. “They’re prioritizing essentials and value-driven discretionary buys, which is why we see strength in groceries and apparel over luxury goods.” Indeed, clothing and accessories stores rose 0.7%, fueled by fall fashion trends and early Black Friday teasers.

This adaptability is crucial as inflation eases but remains sticky in services. The Consumer Price Index for October showed a 0.1% monthly increase, with core inflation at 4.0% annually—down from peaks but still prompting Fed vigilance. Retail sales data like this reassures policymakers that consumer spending isn’t buckling under pressure, potentially allowing for a pause in rate hikes at the upcoming December meeting.

Economists Cheer Data as Recession Fears Fade

The October retail sales figures have prompted a wave of positive reactions from economists, who had braced for softer numbers amid global uncertainties like Middle East tensions and China’s economic slowdown. Forecasts from Bloomberg and Reuters pegged growth at just 0.3%, making the 0.5% actual a clear beat. This surprise has shifted sentiment, with recession probabilities dropping in some models.

The New York Fed’s recession probability gauge, based on yield curve data, fell to 12% for the next 12 months from 15% pre-release. JPMorgan Chase economist Michael Feroli noted in a research note, “This report reinforces our view that the US economy is on track for a shallow slowdown rather than a deep recession. Consumer spending remains the bedrock.”

Broader context includes robust third-quarter GDP estimates, now revised upward to 2.8% annualized growth from 2.6%, partly on stronger personal consumption. Recession fears, which intensified after regional bank failures earlier this year, are easing as corporate earnings hold up—S&P 500 companies reported 4.2% profit growth in Q3.

However, caveats abound. Goldman Sachs warns that if holiday spending disappoints, renewed recession fears could emerge by early 2024. “October’s strength is encouraging, but sustainability hinges on holiday performance,” said senior analyst Sarah Kline. The data also influenced markets, with the Dow Jones Industrial Average gaining 0.4% on release day and Treasury yields dipping slightly, reflecting bets on fewer rate hikes.

Holiday Season Looms Large for Retail Trajectory

Looking ahead, October’s retail sales momentum sets a promising tone for the critical holiday shopping period, which typically accounts for 20% of annual retail revenue. Projections from Deloitte forecast holiday sales reaching $1.4 trillion from November through January, a 3.5% increase over last year, propelled by consumer spending in electronics, toys, and apparel.

Retailers are ramping up preparations, with major chains like Target and Best Buy announcing aggressive promotions to capture wallet share. E-commerce is expected to grow 8.5%, per the NRF, as mobile shopping and same-day delivery become norms. Yet, risks linger: potential port strikes on the West Coast could disrupt imports of holiday goods, while persistent inflation might squeeze margins.

The Federal Reserve’s next moves will be pivotal. Chair Jerome Powell has signaled data-dependence, and strong retail sales bolster the case for holding rates steady. If consumer spending sustains, it could pave the way for cuts in mid-2024, easing recession fears further and supporting a virtuous cycle of growth.

Stakeholders from small businesses to Wall Street are watching closely. The Small Business Optimism Index rose to 91.5 in October, its highest since July, citing improved sales prospects. As Black Friday approaches on November 24, this retail sales data serves as a beacon, suggesting the economy’s pulse is beating stronger than anticipated.

In the months ahead, monthly retail sales reports will be scrutinized for signs of fatigue. If consumer spending holds resilient, it could definitively quash recession fears and guide the US economy toward sustained expansion. Policymakers, investors, and shoppers alike will hope October’s vigor is no fluke but a harbinger of brighter days.