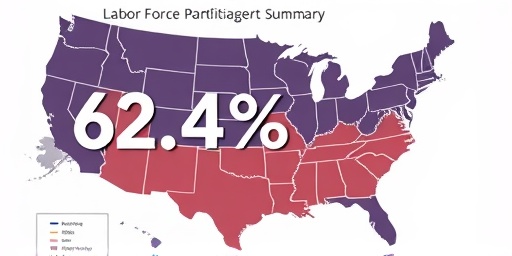

In the latest snapshot of the American workforce, the Bureau of Labor Statistics (BLS) reported that the labor force participation rate held firm at 62.4 percent in September 2025, showing minimal fluctuation from the previous month and year. This stability comes as the Employment-population ratio edged to 59.7 percent, unchanged monthly but reflecting a slight 0.4 percentage point decline over the past year. These figures, part of the Employment Situation Summary for 2025 results, underscore a resilient yet cautious job market navigating post-pandemic recovery and economic uncertainties.

- September Payroll Gains Signal Robust Job Creation

- Labor Force Participation: A Closer Look at Monthly and Annual Stability

- Employment-Population Ratio’s Yearly Dip Sparks Policy Debates

- Economic Implications and Sectoral Winners in the 2025 Job Market

- Looking Ahead: Challenges and Opportunities Shaping Future Labor Trends

Economists view this as a strong indicator of workforce steadiness, even as broader challenges like inflation and technological shifts influence hiring trends. The data, released on October 4, 2025, highlights how millions of Americans continue to engage with the labor market despite evolving dynamics.

September Payroll Gains Signal Robust Job Creation

Delving deeper into the 2025 results, nonfarm payroll Employment surged by 254,000 jobs in September, surpassing analyst expectations of around 200,000. This strong performance was driven by sectors like healthcare, which added 48,000 positions, and leisure and hospitality, contributing 39,000 new roles. Professional and business services also saw gains of 32,000, reflecting ongoing demand for skilled labor in consulting and tech support.

The unemployment rate ticked down slightly to 4.1 percent, a positive shift from August’s 4.2 percent. This improvement points to a tightening labor market where job seekers are finding opportunities more readily. ‘These numbers paint a picture of a strong labor force that’s adapting well to current economic pressures,’ said Dr. Elena Ramirez, chief economist at the National Economic Research Institute. Her assessment aligns with the summary’s emphasis on stable participation rates.

However, not all sectors shared in the growth. Manufacturing lost 12,000 jobs, continuing a trend of slowdowns due to supply chain disruptions and automation. Retail trade remained flat, with only modest increases in e-commerce offsetting declines in brick-and-mortar stores. These disparities highlight the uneven recovery across industries, a key theme in the employment situation analysis.

- Healthcare Boom: Hospitals and outpatient care facilities led the charge, adding roles for nurses and administrative staff amid rising demand for medical services.

- Hospitality Rebound: Restaurants and hotels benefited from seasonal travel spikes, though staffing shortages persist.

- Tech’s Steady Climb: Information services grew by 15,000, fueled by AI and cybersecurity needs.

Average hourly earnings rose by 0.3 percent to $35.42, pushing year-over-year wage growth to 3.8 percent. This uptick supports consumer spending but also raises concerns about inflationary pressures, as the Federal Reserve monitors wage spirals closely.

Labor Force Participation: A Closer Look at Monthly and Annual Stability

The labor force participation rate’s consistency at 62.4 percent marks a return to pre-pandemic levels for many demographics, yet it masks underlying shifts. For prime-age workers (25-54 years), participation climbed to 83.2 percent, up 0.1 point from August, indicating stronger engagement among this core group. In contrast, older workers (55+) saw a dip to 38.5 percent, influenced by early retirements and health-related exits.

Over the year, the rate’s stability contrasts with 2024’s volatility, when it hovered around 62.1 percent amid recession fears. The 2025 results suggest that policy measures like extended child tax credits and remote work incentives have bolstered participation. Women, in particular, drove gains, with their rate reaching 57.1 percent, the highest since 2000, thanks to flexible work arrangements in education and finance sectors.

Geographically, urban areas outperformed rural ones, with participation in major metros like New York and San Francisco at 63.5 percent compared to 60.2 percent in rural Midwest states. This urban-rural divide underscores the need for targeted investments in infrastructure and training programs to bridge gaps.

‘The labor force participation rate’s steadiness is a strong vote of confidence in the economy, but we can’t ignore the demographic pressures at play,’ noted BLS Commissioner Jared Bernstein during a press briefing.

Racial and ethnic breakdowns reveal nuances: Black participation rose to 62.8 percent, while Hispanic rates held at 66.1 percent, both showing resilience. Asian Americans led at 64.3 percent, benefiting from high-skilled immigration trends. These details from the summary provide a multifaceted view of how diverse groups are faring in the current employment situation.

Employment-Population Ratio’s Yearly Dip Sparks Policy Debates

While monthly changes were negligible, the employment-population ratio’s 0.4 percentage point annual decline to 59.7 percent has ignited discussions on long-term workforce health. This metric, which measures the proportion of the population that is employed, fell due to slower population growth outpacing job additions in some regions. It stands 2.3 points below February 2020 levels, a stark reminder of pandemic scars.

Part-time employment for economic reasons affected 4.1 million workers, up slightly from last month, as many juggle gig economy roles amid full-time shortages. The summary’s results also note that 5.8 million individuals were marginally attached to the labor force, wanting work but not actively searching— a group often overlooked in headline figures.

Policy experts are calling for renewed focus on upskilling initiatives. ‘To reverse this ratio’s downward trend, we need investments in vocational training and mental health support to bring sidelined workers back,’ argued Sarah Thompson, policy director at the Workforce Innovation Center. Her comments resonate with the strong labor force dynamics observed, yet highlight vulnerabilities.

- Demographic Shifts: Aging baby boomers exiting the workforce contribute to the dip, with projections estimating a 1 million worker shortfall by 2030.

- Education Impact: Workers with bachelor’s degrees boast an 68.4 percent ratio, versus 55.2 percent for those without high school diplomas.

- Regional Variations: Southern states like Texas saw ratios climb to 61.2 percent on energy sector booms, while Northeastern rust belt areas lagged at 58.1 percent.

The interplay between participation and employment ratios illustrates a labor market that’s strong in growth but challenged in inclusivity, per the 2025 employment situation summary.

Economic Implications and Sectoral Winners in the 2025 Job Market

Beyond the headline stats, the September 2025 results reveal broader economic ripple effects. Consumer confidence indices, such as the Conference Board’s measure, rose to 105.3, buoyed by stable employment signals. Retail sales are projected to increase 2.5 percent in Q4, driven by wage gains and holiday hiring.

Yet, inflation remains a wildcard. With core CPI at 2.6 percent year-over-year, the Fed’s recent rate cut to 4.75 percent aims to sustain this momentum without overheating. ‘The employment situation is strong enough to support soft landing scenarios, but vigilance is key,’ stated Federal Reserve Chair Jerome Powell in a post-report statement.

Sectoral breakdowns offer optimism: Construction added 22,000 jobs, aided by infrastructure bills, while education saw 18,000 gains from back-to-school demands. Conversely, federal government employment dropped by 10,000 due to budget constraints, affecting administrative roles.

Immigration’s role can’t be understated; net migration contributed to 1.2 million of the year’s labor force growth, filling gaps in agriculture and tech. This influx has helped maintain the participation rate’s strength, though debates on visa policies intensify.

Small businesses, employing nearly half the workforce, reported hiring intentions at 45 percent in NFIB surveys, up from 40 percent last quarter. This entrepreneurial vigor bodes well for sustained 2025 results.

Looking Ahead: Challenges and Opportunities Shaping Future Labor Trends

As 2025 draws to a close, the stable labor force participation rate and nuanced employment situation set the stage for cautious optimism. Analysts forecast October payrolls around 220,000, with participation potentially edging to 62.5 percent if seasonal hiring accelerates. However, risks like geopolitical tensions and AI-driven displacements loom large.

Government initiatives, including the proposed $500 billion workforce development act, could boost ratios by targeting underrepresented groups. States like California are piloting AI ethics training programs to safeguard jobs, potentially influencing national trends.

Investors are watching closely; the S&P 500 climbed 1.2 percent post-report, reflecting bets on continued growth. For workers, the message is clear: upskilling remains essential in this strong yet evolving market. The 2025 results remind us that while stability prevails, proactive measures will determine the labor force’s trajectory into 2026 and beyond.