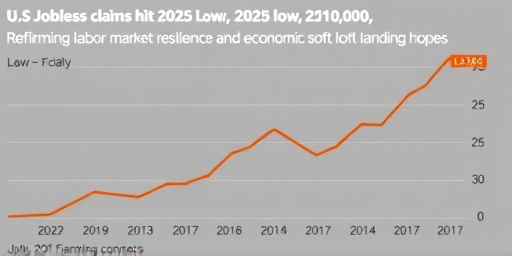

In a promising sign for the US economy, weekly initial Jobless claims dropped sharply to 210,000 for the week ending October 12, 2025, marking the lowest level recorded this year. This decline from the previous week’s 225,000 filings underscores the ongoing strength in the labor market, even as the Federal Reserve navigates interest rate policies amid cooling inflation. With the unemployment rate holding steady at 4.1%, economists are increasingly optimistic about achieving a soft landing, where growth continues without tipping into recession.

Federal Reserve Eyes Labor Data for Rate Cut Signals

The latest figures on Jobless claims come at a critical juncture for monetary policy. The Federal Reserve has been closely monitoring labor market indicators to gauge the economy’s health, and this drop to 210,000—the lowest since early January—provides fresh evidence of resilience. Economists had forecasted around 220,000 claims, making the actual number a pleasant surprise that could influence upcoming decisions on interest rates.

According to data released by the Department of Labor on Thursday, the four-week moving average of initial claims also eased to 218,750, down from 222,000 the prior week. This smoothed metric helps filter out weekly volatility and paints a clearer picture of the labor market’s trajectory. ‘The sustained low level of Jobless claims suggests that employers are holding onto workers despite economic headwinds,’ said Mark Zandi, chief economist at Moody’s Analytics. ‘This bolsters our view that the unemployment rate will remain anchored near current levels.’

Contextually, the labor market has shown remarkable durability throughout 2025. Following a spike in claims earlier in the year due to seasonal adjustments in sectors like manufacturing and retail, filings have trended downward. In comparison, the peak during the brief economic slowdown in Q1 reached 280,000, highlighting the recovery’s momentum. The current data aligns with nonfarm payroll gains of 254,000 jobs reported last month, further solidifying the narrative of a robust job market.

Unemployment Rate Stability Masks Sectoral Shifts

While the headline unemployment rate of 4.1% remained unchanged from the previous month, underlying dynamics reveal a labor market that is adapting rather than stagnating. The Bureau of Labor Statistics’ September report, which informed this week’s claims data, showed that the rate has hovered between 4.0% and 4.2% for much of the year, a far cry from the 3.8% low seen in late 2024.

Breaking it down, the stability can be attributed to several factors. First, wage growth has moderated to around 3.5% annually, easing pressure on inflation without prompting mass layoffs. Second, sectors like healthcare and technology continue to add jobs at a brisk pace, offsetting slowdowns in construction and finance. For instance, healthcare employment rose by 45,000 in September alone, while professional and business services contributed another 52,000 positions.

However, not all indicators are glowing. Continuing claims, which measure those receiving ongoing unemployment benefits, ticked up slightly to 1.82 million for the week ending October 5. This uptick suggests that while new job losses are down, the duration of unemployment for some workers is extending. ‘The labor market is bifurcated,’ noted Ellen Zentner, senior US economist at Morgan Stanley. ‘High-skilled workers in tech and finance are faring well, but lower-wage sectors face more uncertainty due to consumer spending patterns.’

To illustrate the broader picture, consider the labor force participation rate, which edged up to 62.8% last month. This increase indicates more Americans are entering or re-entering the workforce, potentially keeping the unemployment rate in check. Demographically, the rate for prime-age workers (25-54) stands at a healthy 3.7%, while it’s higher at 5.6% for those aged 16-24, reflecting youth employment challenges.

Jobless Claims Decline Fuels Soft Landing Optimism

The drop in jobless claims has reignited discussions around the economy’s potential for a soft landing—a scenario where inflation returns to the Fed’s 2% target without a sharp rise in unemployment. With claims at their 2025 nadir, market participants are betting on continued stability. The soft landing probability, as gauged by Bloomberg economists, now stands at 65%, up from 55% at the start of the quarter.

Key to this optimism is the interplay between the labor market and inflation. Consumer prices rose 2.4% year-over-year in September, the slowest pace since 2021, partly because a strong job market hasn’t overheated into excessive wage pressures. ‘Low jobless claims mean fewer workers are entering the unemployment pool, which supports consumer confidence and spending,’ explained Julia Coronado, founder of Macro Advisory Partners. ‘This virtuous cycle is exactly what the Fed hoped for after its rate hiking campaign.’

Looking at historical parallels, the last time initial claims dipped below 215,000 for multiple weeks was in 2019, pre-pandemic, when the economy was in expansion mode. Today’s environment, though, includes unique pressures like supply chain remnants and geopolitical tensions. Despite these, the labor market’s performance has exceeded expectations set during the Fed’s aggressive rate hikes from 2022 to 2024, which peaked at 5.25%-5.50%.

Regional variations add nuance to the national trend. States like California and Texas, which account for a large share of claims, reported declines of 12% and 8%, respectively, driven by robust service sector growth. Conversely, manufacturing-heavy Midwest states saw milder improvements, with claims down only 3-5%. This geographic disparity underscores the economy’s uneven recovery, but overall, the data points to strength.

Economists and Investors React to Labor Market Resilience

Wall Street’s response to the latest jobless claims was swift and positive. The Dow Jones Industrial Average climbed 0.8% on the day of the release, while the S&P 500 notched a 1.1% gain, reflecting investor confidence in the economy’s trajectory. Bond yields dipped slightly, with the 10-year Treasury falling to 4.05%, signaling expectations of potential rate cuts as early as December.

Expert commentary poured in, emphasizing the implications for policy and growth. ‘This is a green light for the labor market,’ said Michael Feroli, chief US economist at JPMorgan Chase. ‘With unemployment steady at 4.1% and claims trending low, the risk of a hard landing has diminished significantly.’ Feroli’s team now projects GDP growth of 2.2% for Q4 2025, up from their prior 1.9% estimate.

On the fiscal side, the data arrives amid debates over government spending. The Biden administration has touted the labor market’s strength as evidence of effective stimulus measures from the American Rescue Plan. Critics, however, point to the $34 trillion national debt as a looming concern. Treasury Secretary Janet Yellen, in a recent speech, referenced the low jobless claims as ‘proof that our economy is firing on all cylinders.’

From a global perspective, the US labor market’s vigor contrasts with slowdowns in Europe and Asia. The Eurozone’s unemployment rate rose to 6.5% in September, while China’s youth unemployment exceeds 15%. This divergence positions the US as a beacon for international investors, potentially attracting capital inflows that further buttress the economy.

Challenges persist, particularly in gig economy roles and remote work transitions. Surveys from Indeed and LinkedIn show that 28% of workers are considering job changes due to AI automation fears, yet hiring intent remains high at 72% among employers. The interplay of technology and labor dynamics will be crucial in sustaining low jobless claims moving forward.

Future Outlook: Rate Cuts and Economic Expansion on Horizon

As the year progresses, the labor market’s strength positions the economy for measured expansion. The next Federal Open Market Committee meeting in November will scrutinize these jobless claims alongside other data, with a 75% chance of a 25-basis-point rate cut priced into futures markets. If claims continue to hover near 210,000, the Fed could ease policy without reigniting inflation.

Looking ahead, projections from the Congressional Budget Office forecast the unemployment rate stabilizing around 4.2% through 2026, supported by annual job growth of 150,000-200,000. This pace would maintain labor market tightness, potentially leading to gradual wage increases that benefit workers without derailing price stability.

Business leaders are also optimistic. In a recent survey by the National Association of Manufacturers, 68% of executives plan to expand hiring in the coming quarters, citing low unemployment and stable jobless claims as key confidence boosters. For consumers, this translates to sustained spending power, with retail sales expected to rise 2.5% this holiday season.

Yet, risks remain. Geopolitical events, such as ongoing trade tensions with China, could disrupt supply chains and indirectly affect the labor market. A sudden spike in energy prices might also pressure manufacturing jobs. Nonetheless, the current trajectory of low jobless claims and steady unemployment offers a solid foundation for policymakers and investors alike.

In the broader economic landscape, this data reinforces the narrative of resilience. As the US navigates post-pandemic recovery, the labor market’s performance will be pivotal in determining whether 2025 ends on a high note, paving the way for sustained growth into the new year.