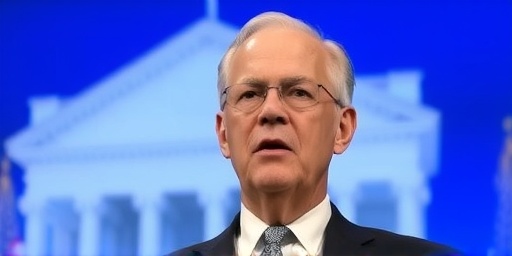

In a series of recent speeches, Federal Reserve Chair Jerome Powell has poured cold water on expectations for imminent interest rate cuts, signaling that Fed rates are likely to remain steady in the near term. This hawkish tone has ignited a sharp selloff in the bond market, with U.S. Treasuries experiencing their steepest declines in months. Investors, caught off guard by the lack of dovish hints, are now recalibrating their portfolios as markets price in a prolonged period of elevated interest rates potentially extending through the first quarter of 2026.

The immediate fallout was evident on Wall Street, where the 10-year Treasury yield surged above 4.2% on Friday, up from 4.0% just days earlier. This yield spike reflects a rush to sell bonds, driving prices down and underscoring the sensitivity of fixed-income markets to central bank rhetoric. Powell’s comments, delivered at economic forums in New York and Washington, emphasized the Fed’s commitment to combating persistent inflation without rushing into policy easing, a stance that has reshaped trader sentiment overnight.

According to Bloomberg data, the probability of a rate cut by the March 2025 Fed meeting has plummeted from 65% to just 35% in the span of a week, based on futures pricing. This shift highlights how Jerome Powell‘s words carry outsized influence in an era of economic uncertainty, where every syllable is dissected for clues on the trajectory of interest rates.

Powell’s Hawkish Speeches Reshape Fed Rate Outlook

Jerome Powell’s latest public appearances have been a masterclass in measured communication, but the underlying message was unmistakable: the Federal Reserve is in no hurry to lower Fed rates. Speaking at the Economic Club of New York on Thursday, Powell reiterated that inflation remains ‘stubbornly above target,’ hovering around 3.2% as per the latest Consumer Price Index reading. ‘We will not cut rates until we have greater confidence that inflation is sustainably moving toward 2%,’ he stated, echoing sentiments from his Jackson Hole address last summer but with renewed vigor.

This wasn’t an isolated remark. In a follow-up speech at the Brookings Institution, Powell delved into the labor market’s resilience, noting that unemployment stands at a historically low 4.1% and wage growth continues to outpace productivity in key sectors. These factors, he argued, necessitate a cautious approach to interest rates to avoid overheating the economy. Economists like those at Goldman Sachs have interpreted these speeches as a clear pivot away from the more accommodative language used in mid-2024, when markets anticipated at least two cuts by year-end.

The context for Powell’s remarks is rooted in the Fed’s dual mandate of price stability and maximum employment. Since hiking rates to a 5.25%-5.50% range in July 2023, the central bank has held steady through nine consecutive meetings, a patience that Powell defended as necessary amid geopolitical tensions and supply chain disruptions. ‘The risks of acting too soon are far greater than waiting a bit longer,’ he added, a quote that’s now circulating widely among bond traders.

Historical parallels abound; recall how Powell’s 2018 comments on ‘accommodative’ policy led to a bond rally, only for subsequent hikes to reverse course. Today, his steady-rate hints are reversing those dynamics, prompting a reevaluation of the Fed’s path. Analysts at JPMorgan estimate that without fresh data showing cooling inflation, Fed rates could linger at current levels well into 2025, impacting everything from mortgage refinancing to corporate borrowing costs.

Bond Market Selloff Intensifies as Yields Climb Sharply

The bond market reacted swiftly and severely to Jerome Powell‘s signals, with a cascade of selling pressure hitting U.S. Treasuries across the yield curve. The benchmark 10-year note saw its price drop 1.2% in a single session, pushing yields to 4.25%—the highest since May. Shorter-term securities fared no better; two-year Treasury yields jumped 15 basis points to 4.45%, reflecting bets on sustained high interest rates.

This selloff isn’t confined to Treasuries. Corporate bonds, particularly investment-grade issues from tech giants like Apple and Microsoft, experienced outflows of over $2 billion last week, per Morningstar data. High-yield bonds, often seen as riskier proxies for economic health, widened spreads by 25 basis points, signaling investor caution. The iShares 20+ Year Treasury Bond ETF (TLT) tumbled 2.5%, erasing gains from the prior month and underscoring the vulnerability of long-duration assets to rate surprises.

What drove this intensity? Market participants had been pricing in a ‘soft landing’ scenario, with rate cuts as the reward for moderating inflation. Powell’s dismissal of that timeline—implicitly extending the pause—shattered the narrative. ‘It’s a reality check for the bond market,’ said Rick Rieder, BlackRock’s chief investment officer, in a CNBC interview. ‘Yields are adjusting to a world where Fed rates stay elevated longer than anyone wanted.’

Globally, the ripple effects were felt too. German Bund yields rose in sympathy, climbing to 2.3%, while emerging market bonds faced renewed selling from U.S. dollar strength. The dollar index (DXY) gained 0.8% against major currencies, further pressuring international fixed-income holdings. For U.S. investors, the selloff means higher borrowing costs; 30-year fixed mortgage rates, which track the 10-year Treasury, have now edged toward 7%, deterring homebuyers and slowing the housing recovery.

Volume data from the New York Fed shows trading activity in Treasuries spiked 40% above average, with algorithmic funds leading the exodus. This liquidity drain highlights a structural shift: in a high-rate environment, duration risk is back with a vengeance, forcing portfolio managers to rethink allocations away from bonds toward equities or cash equivalents.

Markets Recalibrate: Higher Odds of Rates Holding Until 2026

As the dust settles from Powell’s speeches, futures markets are embedding a stark new reality: interest rates may not budge until at least Q1 2026. CME FedWatch Tool data indicates that the odds of rates remaining unchanged through the December 2025 meeting have surged to 75%, up from 50% pre-speeches. By March 2026, the probability of a first cut has dipped below 20%, a dramatic repricing that extends the high-rate horizon by nearly a year.

This adjustment stems from a confluence of indicators. The Fed’s preferred gauge, the Personal Consumption Expenditures (PCE) index, showed core inflation at 2.7% in August, still shy of the 2% goal. Powell highlighted ‘sticky’ services inflation—think rent and healthcare—as a persistent drag, suggesting that even if headline figures ease, underlying pressures could justify steady Fed rates.

Traders are also eyeing upcoming data releases, including the September jobs report due Friday, which could either reinforce or challenge Powell’s view. If nonfarm payrolls exceed 200,000 and wages tick up, it would bolster the case for patience. Conversely, a softening labor market might prompt a rethink, though Powell has cautioned against overreacting to single prints.

Institutional investors are adapting accordingly. Pension funds, major bond holders, are reportedly trimming exposure by 5-10% this quarter, per Pensions & Investments surveys. Hedge funds like Citadel have shorted Treasuries, profiting from the yield ascent. ‘The bond market is pricing in Powell’s patience as policy,’ noted Krishna Guha, vice chairman at Evercore ISI, in a research note. This recalibration extends to equity markets, where rate-sensitive sectors like real estate investment trusts (REITs) have slid 3% since the speeches.

Broader economic models, such as those from the San Francisco Fed, project that sustained 5% interest rates could shave 0.5% off GDP growth in 2025, a trade-off Powell seems willing to accept to anchor inflation expectations.

Wall Street Experts Decode Powell’s Impact on Economy and Investments

Financial pundits and economists are unanimous in their assessment: Jerome Powell‘s steady-rate hints have upended the investment landscape, demanding a strategic pivot from market participants. ‘This is a wake-up call for anyone betting on quick Fed easing,’ warned Mohamed El-Erian, Allianz’s chief economic advisor, during a Bloomberg panel. He pointed to the bond market selloff as evidence of fraying confidence, with yields now reflecting a ‘higher for longer’ mantra that’s become the Fed’s unofficial creed.

From a macroeconomic lens, experts like those at Moody’s Analytics foresee prolonged interest rates curbing consumer spending. Auto loans, already at 7.5% averages, could deter big-ticket purchases, while credit card delinquencies—up 4% year-over-year—signal household strain. ‘The Fed’s caution is prudent, but it risks tipping the economy into stagnation,’ said Mark Zandi, chief economist at Moody’s.

On the investment front, diversification is the buzzword. Bond ladders are being extended, with a focus on floating-rate notes that benefit from rising yields. Equity strategists at Bank of America recommend tilting toward value stocks in financials and energy, sectors that thrive in high-rate regimes. ‘Avoid growth darlings; they’re poisoned by elevated Fed rates,’ advised Savita Subramanian in her latest report.

International perspectives add nuance. European Central Bank officials, facing similar inflation woes, may follow the Fed’s lead, keeping ECB rates at 4%. This synchronization could stabilize global capital flows but amplify pressure on developing economies. IMF projections warn of a 1.2% hit to emerging market growth if U.S. interest rates persist.

Retail investors aren’t immune; apps like Robinhood report a 15% uptick in queries about ‘Fed rates’ post-speeches, with many shifting to money market funds yielding 5%. Financial advisors urge stress-testing portfolios against a no-cut scenario, emphasizing that Powell’s words aren’t bluster—they’re a blueprint for policy.

Looking Ahead: Economic Ramifications and Fed’s Next Moves

As markets digest the implications of Powell’s stance, the path forward bristles with uncertainties that could redefine the U.S. economy’s trajectory. With the Fed’s November meeting looming, all eyes will be on incoming data: if inflation ticks higher or jobs data surprises to the upside, Fed rates could even face upward pressure, though Powell has downplayed hikes as ‘highly unlikely.’

For businesses, sustained interest rates mean tighter credit conditions. Small firms, reliant on variable-rate loans, may delay expansions, potentially cooling the hiring boom. Larger corporations like those in the S&P 500 are refinancing debt at premiums, with investment-grade issuance costs up 20 basis points since the selloff.

Consumers face a mixed bag: savers benefit from juicier CD yields topping 5%, but borrowers grapple with sticker shock on everything from student loans to home equity lines. Housing starts, already down 5% year-to-date, could stagnate further if mortgage rates hold near 7%.

Geopolitically, high rates bolster the dollar, aiding U.S. imports but hurting exporters. Trade tensions with China, amplified by tariffs, could exacerbate inflationary pass-through, giving the Fed more reason to stand pat. Powell’s team at the Fed is reportedly modeling scenarios through 2026, with quarterly projections due in December that may formalize the extended pause.

Ultimately, this episode reinforces the Fed’s pivotal role in steering markets. Investors are advised to monitor Powell’s upcoming testimony before Congress in early October, where he may elaborate on his vision. In a world of volatile interest rates, adaptability will separate the resilient from the rattled, as the bond market continues to echo the chair’s deliberate rhythm.