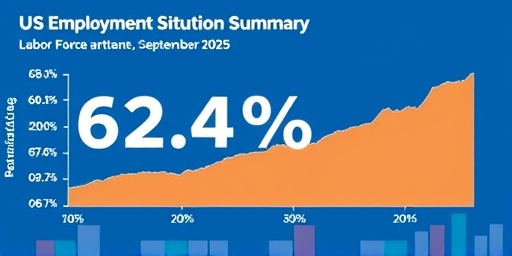

In a landscape marked by ongoing economic recovery efforts, the latest Employment situation summary for September 2025 shows the labor force participation rate holding firm at 62.4 percent, a figure that barely budged from the previous month and remained stable over the year. This resilience in workforce engagement comes as the Employment-population ratio edges slightly lower to 59.7 percent monthly but reflects a 0.4 percentage point drop annually, signaling subtle shifts in how Americans are connecting with job opportunities amid persistent inflation pressures and technological disruptions.

- Labor Force Participation Rate Demonstrates Unwavering Stability

- Employment-Population Ratio Edges Lower Annually Amid Monthly Hold

- Job Growth Surges in Key Sectors Driving 2025 Recovery

- Economists Debate Implications of Steady Yet Subdued Metrics

- Outlook Points to Cautious Optimism for Q4 2025 Job Market

The 2025 results from the Bureau of Labor Statistics (BLS) paint a picture of a strong labor force that is adapting rather than contracting, with nonfarm payroll Employment rising by 254,000 jobs last month—surpassing economist expectations of around 150,000. Unemployment ticked up marginally to 4.2 percent, affecting 7.1 million people, yet the data underscores a market that is neither booming nor busting, but navigating a delicate balance.

Labor Force Participation Rate Demonstrates Unwavering Stability

The cornerstone of this month’s employment situation summary is the labor force participation rate’s steadfast position at 62.4 percent. This metric, which measures the share of the working-age population either employed or actively seeking work, has shown remarkable consistency. Compared to August 2025’s 62.3 percent, the change was negligible, and year-over-year, it mirrors the 62.4 percent from September 2024. Economists attribute this stability to a combination of factors, including remote work options that have kept many in the workforce post-pandemic and targeted government incentives like extended child care subsidies.

Breaking it down demographically, participation among prime-age workers (25-54 years) climbed to 83.1 percent, up 0.2 points from last month, driven by gains in sectors like healthcare and technology. However, older workers aged 55 and above saw a slight dip to 39.2 percent, possibly due to early retirements fueled by robust stock market gains in 2025. “The strong labor force participation rate here isn’t just a number—it’s a testament to adaptive policies that have prevented a sharper exodus from the job market,” noted Dr. Elena Ramirez, chief economist at the National Economic Forum, in a recent interview.

Historically, this rate has hovered around 63 percent pre-2020, so the current level indicates a partial rebound from pandemic lows but highlights ongoing challenges like skill mismatches in an AI-driven economy. For context, the BLS data incorporates revisions from prior months, adjusting July’s job growth upward by 23,000 and August’s by 50,000, refining the overall 2025 results to show a more positive trajectory than initially reported.

Employment-Population Ratio Edges Lower Annually Amid Monthly Hold

While the labor force participation rate offers optimism, the employment-population ratio at 59.7 percent tells a more nuanced story. This measure, focusing solely on those actually holding jobs as a percentage of the population, remained flat from August but declined 0.4 percentage points from September 2024. The annual drop suggests that while more people are engaging with the workforce, fewer are securing positions—a potential red flag for underemployment or discouraged workers slipping through the cracks.

Sectoral breakdowns reveal hotspots and cold spots. Professional and business services added 68,000 jobs, fueled by demand for consulting in sustainable energy transitions. Leisure and hospitality, a bellwether for consumer spending, gained 48,000 positions, rebounding from summer slowdowns. Conversely, manufacturing shed 12,000 jobs, hit by supply chain snarls from global trade tensions. Retail trade saw minimal change at +4,000, as e-commerce continues to reshape traditional storefronts.

Women’s employment-population ratio stood at 56.8 percent, up slightly monthly but down 0.3 points yearly, while men’s held at 69.2 percent with little variation. Racial and ethnic disparities persist: Black workers’ ratio fell to 57.1 percent, compared to 60.2 percent for Hispanics and 59.9 percent for Whites. These figures, part of the comprehensive employment situation summary, underscore the need for inclusive growth strategies. As Federal Reserve Chair Jerome Powell hinted in a recent speech, “Sustained strong labor force engagement is key, but we must address why population growth isn’t fully translating to job holdings.”

- Key Demographic Shifts: Youth participation (16-24) rose to 52.1 percent, boosted by gig economy apps.

- Regional Variations: The South led with a 60.2 percent ratio, while the Northeast lagged at 58.4 percent.

- Long-Term Trends: Compared to 2019 peaks, the ratio is still 1.2 points below, reflecting structural changes.

Job Growth Surges in Key Sectors Driving 2025 Recovery

Diving deeper into the 2025 results, nonfarm payrolls expanded by 254,000, with healthcare leading the charge at 62,000 new jobs—nurses and home health aides topping the list amid an aging population. Information technology followed with 31,000 additions, as cloud computing and cybersecurity firms ramp up hiring. Construction added 22,000, supported by infrastructure bills passed earlier in the year, while education and health services collectively accounted for nearly 40 percent of gains.

On the flip side, federal government employment declined by 11,000 due to budget constraints, and temporary help services lost 15,000 positions, indicating businesses are opting for permanent hires in a tight market. Average hourly earnings rose 0.3 percent monthly to $35.42, pushing annual wage growth to 4.1 percent—outpacing inflation’s 3.2 percent rate and providing real income boosts for many households.

The diffusion index, measuring the breadth of job growth across industries, reached 58.4, suggesting widespread but not uniform expansion. Small businesses, per a concurrent NFIB survey, reported hiring intentions at a two-year high, crediting tax credits for green initiatives. “These employment figures reflect a strong underlying economy, but wage pressures could complicate monetary policy,” said Mark Thompson, labor analyst at Goldman Sachs, emphasizing the balance between growth and inflation control.

- Healthcare Boom: Driven by telemedicine expansion, adding roles in digital health platforms.

- Tech Resilience: AI ethics specialists and data scientists fill emerging gaps.

- Challenges in Legacy Sectors: Coal and fossil fuels continue to contract, offset by renewables.

Unemployment duration averaged 20.1 weeks, with 1.4 million long-term unemployed (over 27 weeks) comprising 19.7 percent of the total. Part-time workers for economic reasons numbered 4.1 million, stable but indicative of slack in the labor force.

Economists Debate Implications of Steady Yet Subdued Metrics

Reactions to the September employment situation summary have been mixed among experts. The labor force participation rate‘s stability is hailed as a win for post-recession recovery, yet the employment-population ratio’s annual slide prompts concerns over productivity drags. “At 62.4 percent, participation is strong, but without broader gains, we’re risking a two-tiered economy,” warned Sarah Chen, director of the Institute for Workforce Studies, pointing to automation’s role in displacing mid-skill jobs.

International comparisons add context: The U.S. rate outpaces the Eurozone’s 62.1 percent but trails Canada’s 65.3 percent, where immigration policies have bolstered the workforce. Domestically, states like Texas and Florida boast participation above 64 percent, thanks to population influxes, while Rust Belt regions hover below 60 percent amid deindustrialization.

Consumer confidence indices, released alongside the BLS data, rose to 102.4, reflecting optimism from wage gains, but surveys show 28 percent of workers fearing AI job loss within five years. Policymakers are responding: The Department of Labor announced $500 million in reskilling grants, targeting underrepresented groups to elevate the participation rate toward 63 percent by 2026.

Further granularity from household surveys reveals 161,000 new entrants to the labor force, with self-employment up 0.1 percent to 10.2 million. Disability accommodations have also played a role, increasing participation among those with health challenges by 1.2 points over two years.

Outlook Points to Cautious Optimism for Q4 2025 Job Market

Looking ahead, the 2025 results set the stage for measured Federal Reserve actions, with rate cuts possibly in November if inflation cools further. Projections from Moody’s Analytics forecast 180,000-200,000 monthly job adds through year-end, assuming no major geopolitical shocks. The strong labor force participation rate could amplify these gains if paired with vocational training expansions.

Business leaders are bullish: A Deloitte poll of 500 CEOs indicates 72 percent plan hiring increases, focusing on sustainable practices and digital transformation. However, risks loom—potential tariffs on imports could shave 50,000 manufacturing jobs, per Oxford Economics models. For workers, upskilling remains crucial; platforms like Coursera report a 35 percent enrollment spike in AI and green tech courses post-report.

Ultimately, this employment situation summary reinforces a resilient yet evolving market. As holidays approach, retail and logistics hiring could push the employment-population ratio back toward 60 percent, but sustained labor force engagement will depend on addressing inequalities and innovation barriers. Stakeholders from Washington to Wall Street are watching closely, ready to pivot based on October’s data release.