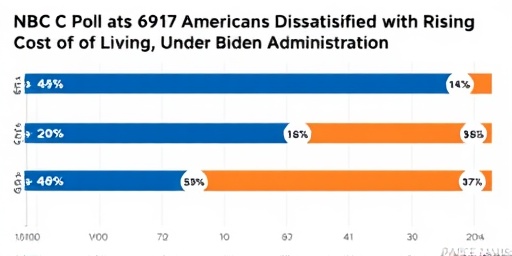

In a stark revelation from a recent NBC News poll, nearly two-thirds of U.S. voters express deep dissatisfaction with the escalating Cost of living, pinning much of the blame on the Biden administration. With inflation continuing to squeeze household budgets, President Joe Biden’s approval rating has dipped to a concerning 43%, highlighting a growing rift between public sentiment and official economic narratives.

The poll, conducted among 1,000 registered voters from October 10-14, underscores widespread frustration across demographics. Respondents cited everyday expenses like groceries, housing, and fuel as primary pain points, with 66% stating that the administration has not done enough to curb the Cost of living crisis. This comes as the national economy shows mixed signals: unemployment remains low at 3.8%, yet consumer confidence is waning amid persistent price hikes.

Poll Breakdown: Surging Discontent Over Inflation’s Grip

The NBC News survey paints a detailed picture of public opinion on the economy, revealing that 62% of Americans view inflation as the most pressing domestic issue facing the nation today. This marks a significant uptick from earlier in the year, when only 55% ranked it as their top concern. Among Democrats, support for Biden’s handling of the economy has eroded, dropping from 72% in mid-2023 to just 58% now, according to pollster insights shared with NBC.

Demographic divides are evident. In urban areas, where housing costs have ballooned by an average of 20% since 2021, dissatisfaction reaches 71%. Rural voters, grappling with higher fuel and agricultural input prices, report 65% unhappiness. Women, who often manage family budgets, showed 68% disapproval rates, compared to 64% for men. The poll also highlighted partisan gaps: 92% of Republicans and 78% of independents believe the Biden administration has mishandled the Cost of living, while only 28% of Democrats agree.

“The numbers don’t lie—Americans are feeling the pinch every time they fill up their tank or check out at the grocery store,” said poll director Emily Chen during an NBC interview. She noted that open-ended responses frequently mentioned “shrinkflation,” where products shrink in size while prices rise, fueling perceptions of economic deceit.

To illustrate the breadth of concerns, the poll included specific queries on cost of living categories:

- Groceries: 74% reported prices up by more than 10% in the past year.

- Housing: 59% said rent or mortgage payments have become unaffordable.

- Energy: 67% cited gasoline prices averaging $3.85 per gallon as a barrier to mobility.

- Healthcare: 52% felt out-of-pocket costs have risen disproportionately.

These statistics align with Bureau of Labor Statistics data, which shows the Consumer Price Index (CPI) for urban consumers rose 3.2% year-over-year in September, down from a peak of 9.1% in June 2022 but still above the Federal Reserve’s 2% target. Economists attribute lingering inflation to supply chain disruptions from the pandemic and geopolitical tensions, including the Russia-Ukraine conflict affecting global energy markets.

Biden’s Approval Slips to 43% Amid Economic Headwinds

President Biden’s overall approval rating of 43% in the NBC poll represents his lowest mark since taking office, a slide largely driven by economic dissatisfaction. Only 41% approve of his economy management, a figure that has plummeted from 50% in late 2022. This erosion in public opinion is particularly alarming for the Biden administration, as it coincides with midterm election aftermath and preparations for 2024.

White House Press Secretary Karine Jean-Pierre addressed the poll during a briefing, emphasizing resilience in the job market. “We’ve added over 14 million jobs since the president took office, and wages are rising faster than inflation for many workers,” she stated. However, critics argue that real wages have declined by about 2.5% when adjusted for inflation, per Federal Reserve analyses, leaving many households treading water financially.

The poll’s timing is crucial, following the Federal Reserve’s recent interest rate hike to 5.25-5.5%, aimed at taming inflation but risking a slowdown in consumer spending. Respondents expressed mixed views: 55% support the Fed’s aggressive stance, but 45% worry it will lead to job losses, reflecting broader anxiety about the cost of living.

Historical context adds weight to these findings. Similar polls during the Carter administration in the late 1970s showed comparable discontent with “stagflation,” contributing to his 1980 election loss. Political analysts like those at FiveThirtyEight suggest Biden’s current ratings mirror those of presidents facing economic turbulence, potentially jeopardizing Democratic prospects in future races.

Individual stories from the poll’s focus groups amplify the data. A 45-year-old teacher from Ohio shared, “My grocery bill used to be $400 a month; now it’s $650. The Biden administration talks recovery, but I see none.” Such anecdotes underscore how public opinion is shifting from abstract numbers to tangible hardships.

White House Pushes Back: Defending Policies Against Public Skepticism

Despite the poll’s grim outlook, the Biden administration remains steadfast in defending its economic playbook. Officials point to the Inflation Reduction Act of 2022 as a cornerstone achievement, which they claim has capped insulin prices at $35 for Medicare recipients and invested $369 billion in clean energy to lower long-term cost of living pressures.

“Our policies are working—inflation is down from its peak, and we’re building an economy from the bottom up and middle out,” President Biden remarked in a recent speech at the Economic Club of Washington, D.C. He highlighted manufacturing resurgence, with 800,000 factory jobs created since 2021, as evidence of progress. Yet, the NBC poll indicates only 39% of voters recognize these gains, with many overshadowed by immediate cost of living woes.

Administration economists, including Council of Economic Advisers Chair Jared Bernstein, have authored op-eds countering the narrative. In a piece for The New York Times, Bernstein argued, “While challenges persist, the U.S. economy outperforms global peers, with GDP growth at 2.8% in Q3 2023.” He cited international comparisons: U.S. inflation at 3.7% versus the Eurozone’s 4.3%.

However, public opinion polls like NBC’s reveal a credibility gap. A separate Gallup survey echoed these sentiments, showing 60% of Americans living paycheck to paycheck, up from 50% pre-pandemic. Critics, including Republican leaders, seize on this, with Senate Minority Leader Mitch McConnell tweeting, “Biden’s economy is a disaster for working families—time for accountability.”

The administration’s response includes targeted initiatives, such as expanding affordable housing credits and student debt relief, which have provided $127 billion in aid to 3.6 million borrowers. Still, the poll suggests these measures haven’t penetrated public consciousness, with only 32% aware of recent relief programs.

Broader Economic Context: From Supply Chains to Global Pressures

The dissatisfaction captured in the NBC poll doesn’t occur in a vacuum; it’s intertwined with global and domestic factors exacerbating the cost of living. The lingering effects of COVID-19 supply chain snarls have driven up prices for everything from semiconductors to shipping containers, contributing to a 25% surge in import costs since 2020.

Geopolitical events amplify these issues. The war in Ukraine has spiked wheat and oil prices, with U.S. households paying an extra $1,000 annually on food due to inflation, according to USDA estimates. Domestically, labor shortages in key sectors like trucking and retail have pushed wages up but also operational costs, passed onto consumers.

Experts from think tanks like the Brookings Institution provide deeper analysis. Economist Mark Zandi noted in an NBC segment, “The Biden administration inherited a recovering economy, but external shocks have tested its resilience. Public opinion lags behind data because pain is immediate, while recovery is gradual.” He predicts inflation could ease to 2.5% by mid-2024 if rate hikes hold, but warns of recession risks if consumer spending falters.

Regional variations add nuance. In high-cost states like California, where median home prices exceed $800,000, 75% of poll respondents feel economically insecure. Conversely, in the Midwest, manufacturing incentives from the CHIPS Act are boosting optimism, with 48% approval for local economic handling.

Consumer behavior reflects this tension: retail sales dipped 0.6% in September, per Commerce Department data, as families cut back on non-essentials. Credit card debt hit a record $1.07 trillion, signaling strained finances amid the cost of living crunch.

Looking ahead, the poll’s implications extend to policy debates. With the 2024 election looming, both parties are recalibrating. Democrats push for expanded social safety nets, while Republicans advocate tax cuts and deregulation to stimulate growth. The Federal Reserve’s next moves, potentially including a pause on hikes, could sway public opinion—if inflation cools without sparking unemployment spikes, Biden’s ratings might rebound.

As Americans navigate these economic currents, the NBC poll serves as a wake-up call. Future surveys will track whether targeted interventions bridge the gap between policy intent and voter reality, potentially reshaping the national conversation on the economy and beyond.