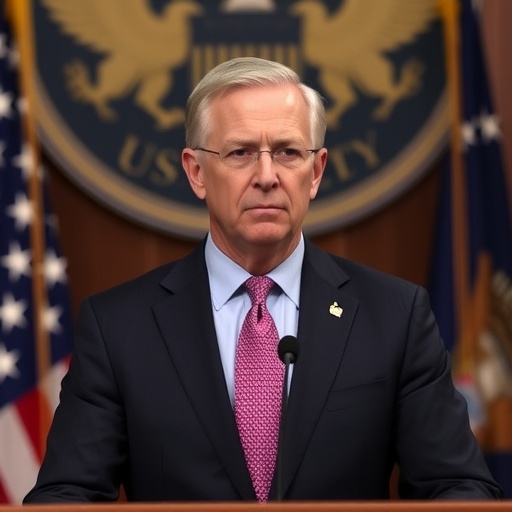

In a stark revelation that has sent ripples through financial markets, US Treasury Secretary Scott Bessent has warned that the housing sector may already be entrenched in a Recession. Speaking at a high-profile economic forum in Washington, Bessent highlighted how persistently high interest rates are strangling the housing market, disproportionately impacting low-income consumers and threatening broader economic stability. He called on the Federal Reserve to slash rates urgently to avert deeper pain across the economy.

Bessent’s Dire Assessment: Housing Recession Already Underway

Scott Bessent, the newly appointed US Treasury Secretary, did not mince words during his address to policymakers and economists. “The housing market is not just cooling—it’s in Recession,” Bessent declared, emphasizing that elevated interest rates have frozen home sales and construction activity to levels unseen since the 2008 financial crisis. According to recent data from the National Association of Realtors, existing home sales plummeted by 18.9% year-over-year in the third quarter, marking the steepest decline since the onset of the COVID-19 pandemic.

Bessent pointed to a confluence of factors driving this downturn. Mortgage rates, hovering around 7.5% for a 30-year fixed loan—the highest in over two decades—have priced out millions of potential buyers. This has led to a severe inventory shortage, with homes lingering on the market for an average of 45 days, up from 30 days just two years ago. For low-income households, the squeeze is even tighter; the median home price has surged to $412,000, making affordability a distant dream for those earning below $50,000 annually.

The Treasury chief’s comments come at a pivotal moment. With inflation cooling but still above the Federal Reserve’s 2% target, the central bank has held interest rates steady at 5.25-5.50% since July 2023. Bessent argued that this caution is now counterproductive, stating, “Delaying rate cuts risks turning a sector-specific recession into a full-blown economic one.” His warning underscores growing tensions between the Treasury and the Fed, as President Biden’s administration pushes for policies to stimulate growth ahead of the 2024 election cycle.

High Interest Rates’ Crushing Grip on the Housing Market

The housing market’s woes are inextricably linked to the Federal Reserve’s aggressive interest rate hikes, initiated in early 2022 to combat post-pandemic inflation. What began as a necessary measure to tame rising prices has morphed into a drag on one of the economy’s key engines. Interest rates directly influence mortgage costs, and with the benchmark 10-year Treasury yield climbing above 4.5%, borrowing has become prohibitively expensive.

Consider the numbers: In 2021, when rates were near zero, monthly mortgage payments on a median-priced home averaged $1,200. Today, that same home at current rates demands over $2,800 per month—a 133% increase that has sidelined first-time buyers and young families. The Urban Institute reports that homeownership rates among millennials have stagnated at 48%, compared to 52% for baby boomers at the same age, largely due to these affordability barriers.

Construction has also ground to a halt. The US Census Bureau notes a 22% drop in housing starts in the past year, with builders citing high material costs and financing challenges as primary culprits. Regional disparities exacerbate the issue; in high-cost states like California and New York, where interest rates compound already sky-high prices, the recession feels more like a depression. In contrast, Sun Belt markets like Texas and Florida have seen some resilience, but even there, sales volumes are down 15%.

Low-income consumers, whom Bessent singled out, are bearing the brunt. Federal Reserve data shows that households earning less than $75,000 have seen rental costs rise 20% since 2022, pushing many into substandard housing or homelessness. Bessent warned that without intervention, this could fuel social unrest and widen inequality gaps, echoing concerns from economists like Joseph Stiglitz who have long criticized the Fed’s one-size-fits-all approach to monetary policy.

Federal Reserve Faces Pressure to Cut Rates and Revive Housing

At the heart of Bessent’s plea is a direct challenge to Federal Reserve Chair Jerome Powell. The Treasury Secretary urged the Fed to initiate rate cuts as early as the next meeting, arguing that waiting for inflation to fully subside ignores the real-time suffering in the housing market. “The Fed’s mandate includes maximum employment and stable prices, but it’s failing on both fronts when housing—affecting 65% of American families—is in freefall,” Bessent said.

Powell’s recent testimonies before Congress have been more dovish, hinting at potential cuts if labor market data softens. However, Fed officials remain divided; Atlanta Fed President Raphael Bostic has advocated for patience, citing persistent wage growth as a inflation risk. Market futures now price in a 75% chance of a 25-basis-point cut in March 2024, up from 50% a month ago, reflecting Bessent’s influence.

Historical precedents abound. During the 2018-2019 rate hike cycle, a similar housing slowdown prompted the Fed to pivot quickly, cutting rates three times and averting a broader recession. Analysts at Goldman Sachs estimate that a 1% rate reduction could boost home sales by 10-15% within six months, injecting $200 billion into related industries like real estate services and manufacturing.

Yet, not all agree with Bessent’s urgency. Critics, including some conservative economists, warn that premature cuts could reignite inflation, pointing to the 1970s stagflation era. Bessent countered this in his speech, noting that current supply-chain improvements and energy price stability provide a window for action without backlash.

Ripple Effects: Low-Income Families and Economic Fallout

The housing recession’s tentacles extend far beyond real estate agents and builders. For low-income consumers, it’s a daily battle. The Joint Center for Housing Studies at Harvard University reports that 22 million renter households spend over 30% of their income on housing, a figure that has doubled since 2001. With interest rates keeping purchase prices elevated, many are locked into renting, perpetuating a cycle of wealth inequality.

Bessent highlighted stories from affected communities: In Rust Belt cities like Detroit and Cleveland, factory workers who once aspired to homeownership are now doubling up in multigenerational homes. Nationally, eviction filings have surged 12% in 2023, per Princeton’s Eviction Lab, correlating directly with the housing slowdown.

Broader economic implications loom large. Housing contributes 15-18% to US GDP, and its recession could shave 0.5-1% off overall growth in 2024, according to Moody’s Analytics. Job losses in construction—already at 20,000 last month—threaten to spill into retail and services. The stock market reacted swiftly to Bessent’s comments, with the S&P 500 Homebuilders Index dropping 3% in after-hours trading.

International observers are watching closely. The European Central Bank, facing similar pressures, cut rates last week, providing a model for the Fed. Bessent’s push aligns with global calls for coordinated easing, potentially stabilizing cross-border investments in US real estate.

Outlook: Policy Shifts and Pathways to Housing Recovery

Looking ahead, Bessent’s intervention could catalyze change. The Treasury is reportedly preparing a package of incentives, including tax credits for first-time buyers and subsidies for affordable housing projects, to complement any Fed action. Bipartisan support is emerging; Senate Majority Leader Chuck Schumer has voiced agreement, calling the housing crisis “the defining economic issue of our time.”

Experts predict a bumpy road. If the Fed cuts rates by mid-2024, the housing market could rebound modestly, with sales increasing 8-10% by year-end, per Zillow forecasts. However, structural issues like zoning laws and supply shortages will require long-term fixes—potentially through federal legislation like the proposed Housing Affordability Act.

For consumers, the message is clear: Monitor Fed announcements closely. As Bessent concluded, “The recession in housing doesn’t have to define our economy’s future. Bold action now can build a stronger foundation for all Americans.” With interest rates at a crossroads and the Federal Reserve under scrutiny, the coming months will test whether policymakers heed this urgent call, preventing the housing market’s downturn from escalating into widespread economic distress.