US-China relations Heat Up: High-Stakes Trade Talks in Malaysia Over Rare Earth Export Controls

In a tense backdrop of escalating global trade frictions, top US and Chinese officials convened secretly in Kuala Lumpur, Malaysia, this week to lay the groundwork for an upcoming summit between President Donald Trump and Chinese President Xi Jinping. The focal point? China’s increasingly stringent controls on rare earth exports, which supply over 80% of the world’s needs for these critical minerals essential to everything from electric vehicles to military hardware. With the US warning of steep tariffs if no agreement is reached, the stakes couldn’t be higher for US-China relations, rare earths supply chains, and the broader landscape of trade talks.

- Behind Closed Doors: Pre-Summit Maneuvers in Kuala Lumpur

- Rare Earths at the Heart: China’s Strategic Leverage in Global Supply Chains

- Tariff Threats and Retaliation: Trump’s Hardline Approach in Trade Talks

- Global Allies Rally: Building a United Front Against Beijing’s Export Tactics

- Toward the Trump-Xi Summit: Implications for Future US-China Trade Dynamics

This meeting, shrouded in diplomatic discretion, underscores the fragility of bilateral ties as both superpowers grapple with economic interdependence and strategic rivalry. Sources close to the negotiations reveal that discussions centered on easing Beijing’s export restrictions, which have tightened amid ongoing trade disputes. Failure to bridge this gap could trigger a cascade of retaliatory measures, disrupting industries worldwide and intensifying the rare earths crisis that has allies rallying against what they call Beijing’s coercive trade tactics.

Behind Closed Doors: Pre-Summit Maneuvers in Kuala Lumpur

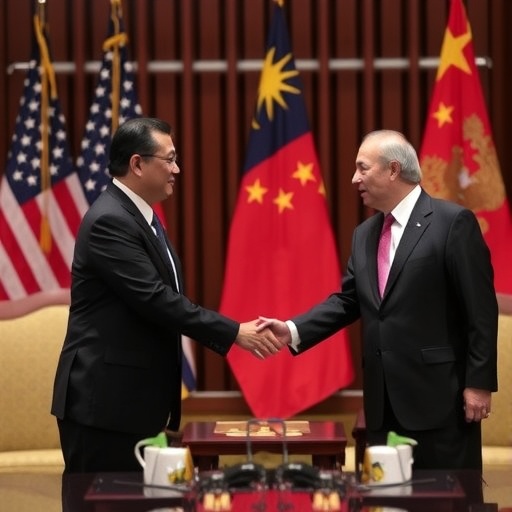

The choice of Malaysia as a neutral venue for these high-level trade talks was no accident. Kuala Lumpur’s role as a diplomatic hub in Southeast Asia provided a low-profile setting away from the prying eyes of Washington and Beijing. US negotiators, led by a team from the Office of the US Trade Representative, arrived with a clear mandate: to address China’s dominance in rare earths and prevent a supply bottleneck that could hamstring American innovation and defense capabilities.

According to a statement from the US State Department, the talks were “productive but challenging,” focusing on “mutual interests in stable supply chains.” Chinese counterparts, represented by officials from the Ministry of Commerce, emphasized Beijing’s right to regulate its resources amid what they describe as unfair US trade practices. One anonymous US diplomat told reporters, “We’re not here to dictate terms, but China’s export controls are a red line. Rare earths aren’t just commodities; they’re the lifeblood of modern technology.”

Historical context adds weight to these discussions. Since the early 2010s, China has controlled approximately 60% of global rare earth mining and over 85% of processing, according to the US Geological Survey. Recent moves, including export quotas tightened in response to US semiconductor restrictions, have raised alarms. In 2023 alone, China’s export licenses for rare earths dropped by 15%, forcing companies like Apple and Tesla to scramble for alternatives.

The pre-summit nature of these talks signals preparation for a face-to-face between Trump and Xi, potentially slated for later this year at the G20 in Indonesia. Trump, known for his aggressive stance on trade, has publicly stated on social media, “China’s rare earth monopoly is a national security threat. Time to level the playing field!” This rhetoric has set the tone, with negotiators aiming to avoid a full-blown crisis ahead of the leaders’ meeting.

Rare Earths at the Heart: China’s Strategic Leverage in Global Supply Chains

Rare earth elements—17 metals including neodymium, dysprosium, and lanthanum—are indispensable for high-tech applications. They power the magnets in wind turbines, the batteries in electric cars, and the guidance systems in fighter jets. Yet, China’s near-monopoly has turned these obscure minerals into a geopolitical flashpoint in US-China relations.

Beijing’s export controls, formalized through a series of policies since 2010, were initially a response to environmental concerns but have evolved into a tool of economic statecraft. In July 2023, China announced stricter licensing requirements, citing national security, which analysts interpret as retaliation for US export bans on advanced chips. The impact has been swift: prices for neodymium oxide surged 25% in the past quarter, per data from Argus Media, affecting US manufacturers from Boeing to General Motors.

Experts highlight the vulnerability. Dr. Jane Li, a supply chain analyst at the Brookings Institution, explained in a recent interview, “China’s grip on rare earths gives it unparalleled leverage. Without diversification, the US risks blackouts in critical sectors. These trade talks are about more than tariffs; they’re about reshaping global dependencies.” Statistics bear this out: the US imports 78% of its rare earths from China, down from 100% a decade ago, thanks to nascent domestic projects like the Mountain Pass mine in California. However, even these efforts process much of their ore in China, underscoring the intertwined nature of US-China relations.

Global demand is exploding, too. The International Energy Agency projects rare earth needs will quadruple by 2040, driven by the green energy transition. Countries like Japan and Australia, burned by past Chinese embargoes, have invested billions in alternative sources—Japan alone spent $2.3 billion on recycling tech since 2011. In the current dispute, these allies are watching closely, with reports of joint US-led initiatives to build a “minerals security partnership” gaining traction.

Tariff Threats and Retaliation: Trump’s Hardline Approach in Trade Talks

President Donald Trump’s administration has made no secret of its willingness to wield tariffs as a weapon in these trade talks. Echoing his first-term playbook, Trump has threatened “steep and immediate” duties on Chinese goods if rare earth export controls aren’t relaxed. Speaking at a campaign rally in Ohio last week, Trump declared, “If Xi doesn’t play fair on rare earths, we’ll hit them where it hurts—our tariffs will make sure America comes first.”

This isn’t bluffing. Under Section 301 of the Trade Act, the US has already imposed tariffs on $300 billion worth of Chinese imports since 2018, with rare earth-related products now in the crosshairs. Economic modelers at the Peterson Institute for International Economics estimate that new tariffs could add 10-15% to costs for US electronics firms, but proponents argue it’s a necessary deterrent. “Short-term pain for long-term gain,” said US Commerce Secretary Gina Raimondo in a congressional hearing, emphasizing the need to onshore production.

China’s response has been measured but firm. Xi Jinping, in a speech to the Communist Party Congress, reiterated Beijing’s commitment to “defending core interests,” including resource sovereignty. State media has accused the US of “hegemonism,” while quietly signaling openness to dialogue. Internal memos leaked to Reuters suggest China is considering limited export increases in exchange for eased tech restrictions, a potential olive branch in the ongoing US-China relations standoff.

The tariff specter extends beyond bilateral ties. European allies, facing their own rare earth shortages, have urged de-escalation. The EU’s Critical Raw Materials Act, passed in March 2023, aims to reduce reliance on China by 65% by 2030, but officials in Brussels warn that US tariffs could spike global prices, hurting everyone. In a joint statement, representatives from the Quad alliance—US, Japan, India, Australia—condemned China’s “trade tactics” and pledged coordinated action.

Global Allies Rally: Building a United Front Against Beijing’s Export Tactics

The rare earths dispute isn’t isolated; it’s galvanizing a coalition of nations wary of China’s trade tactics. Australia, home to the world’s third-largest rare earth deposits, has accelerated its Lynas Rare Earths project, which now supplies 10% of non-Chinese processed rare earths. Prime Minister Anthony Albanese stated, “We stand with our partners to ensure fair access to these vital resources, free from coercion.”

Similarly, Canada and Vietnam are emerging as key players. Canada’s Vital Metals began production at its Nechalacho mine in 2021, targeting US markets, while Vietnam’s Dong Pao project promises to add 5,000 tons annually by 2025. These developments are part of a broader US-led push: the 2022 Inflation Reduction Act allocates $370 million for rare earth processing, aiming to create a domestic supply chain resilient to disruptions.

International forums are buzzing. At the recent WTO meeting in Geneva, 20 member states, including the UK and South Korea, called for transparency in China’s export licensing. A report by the OECD estimates that diversified sourcing could cut global vulnerability by 40%, but it requires investment—up to $10 billion annually, per World Bank figures.

Environmental angles add complexity. Rare earth mining is notoriously polluting, with China’s lax regulations drawing criticism. US firms tout greener methods, like ionic clay extraction in Texas, which reduces water use by 70%. As trade talks progress, sustainability could emerge as a bargaining chip, with Xi Jinping’s “dual carbon” goals—peaking emissions by 2030—offering common ground.

Toward the Trump-Xi Summit: Implications for Future US-China Trade Dynamics

As the Kuala Lumpur talks wrap up, eyes turn to the potential Trump-Xi summit, where leaders could chart a course for de-escalation or deeper conflict. Success might yield a framework for stable rare earths flows, perhaps including joint ventures or WTO-compliant quotas, bolstering US-China relations amid broader trade talks.

Yet risks loom large. If tariffs materialize, analysts predict a 2-3% drag on global GDP growth in 2024, per IMF simulations, with ripple effects on inflation and tech innovation. Domestically, US efforts to revive mining face hurdles: permitting delays and community opposition could take years, leaving a gap that China exploits.

Looking ahead, diversification is key. Initiatives like the US-Australia Critical Minerals Taskforce and EU-China dialogues signal a multipolar future for rare earths. For Trump and Xi, the summit represents a pivotal moment: a chance to temper rivalry with pragmatism, ensuring that trade talks foster cooperation rather than confrontation. As one Beijing-based analyst noted, “In the game of superpowers, resources are the new currency—how they share it will define the decade.”

The world watches, knowing that the outcome of these negotiations could reshape industries, alliances, and the very fabric of global commerce.