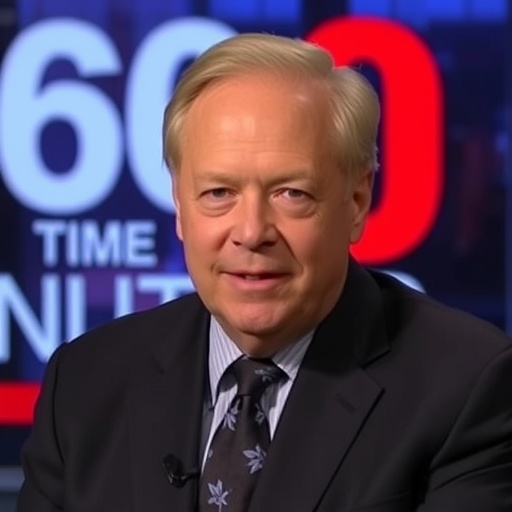

Former 60 Minutes EP Bill Owens Exposes Paramount’s Deep Concerns Over Trump and Gaza Coverage in Bombshell Revelation

In a stunning disclosure that has sent shockwaves through the journalism world, former executive producer of 60 Minutes, Bill Owens, has revealed that Paramount executives were intensely worried about the network’s coverage of Donald Trump and the Israel-Hamas war during his final days at the helm. Owens, who steered CBS’s flagship news magazine for over a decade, painted a picture of internal pressures that threatened the program’s storied independence, highlighting a rare glimpse into the high-stakes decisions shaping prime-time news.

- Owens’ Tenure at 60 Minutes: A Legacy Under Fire

- Paramount’s Grip Tightens on Trump Coverage Amid Election Frenzy

- Gaza Coverage Sparks Intense Internal Debates at CBS

- Industry-Wide Ripples: How Owens’ Claims Expose Journalism’s Corporate Stranglehold

- Future Challenges: Reclaiming Independence in a Fractured Media Landscape

This revelation comes at a time when media scrutiny over bias and corporate influence is at an all-time high, especially with the 2024 U.S. presidential election looming and the Gaza conflict continuing to dominate global headlines. Owens’ account, shared in a recent interview, underscores the delicate balance between editorial freedom and corporate oversight in an era of polarized politics and advertiser sensitivities.

Owens’ Tenure at 60 Minutes: A Legacy Under Fire

Bill Owens joined 60 Minutes in 2009 and rose to become executive producer in 2019, overseeing some of the program’s most impactful investigations. Under his leadership, the show earned multiple Emmys and maintained its reputation as a beacon of investigative journalism, with segments that delved into everything from political corruption to international crises. However, Owens’ final weeks in 2023 were marked by what he described as unprecedented interference from Paramount Global, the parent company of CBS News.

“The atmosphere changed,” Owens recounted in his interview with The Media Insider. “Stories on Trump and Gaza weren’t just edited for clarity; they were scrutinized for potential fallout.” This period coincided with heightened tensions following the October 7, 2023, Hamas attacks on Israel and the subsequent war in Gaza, alongside ongoing debates over Trump’s legal battles and political comeback.

Owens, a veteran journalist with roots in local news and production, brought a no-nonsense approach to 60 Minutes. He championed stories that held power to account, including a 2020 segment on Trump’s handling of the COVID-19 pandemic that drew millions of viewers. Yet, as Paramount faced financial pressures—reporting a $551 million loss in its 2023 third quarter amid streaming wars—executives grew wary of content that could alienate key audiences or advertisers.

Historical context adds depth to Owens’ claims. 60 Minutes has long navigated controversies, from its 1973 interview with White House counsel John Dean during Watergate to more recent clashes over fact-checking. But Owens’ era saw the program adapt to digital disruptions, with viewership dipping to around 5.5 million per episode in 2023, down from peaks of over 20 million in the 1980s. This decline amplified corporate concerns, making high-profile stories like those on Trump and Gaza potential lightning rods.

Insiders note that Owens’ departure was abrupt, announced in September 2023, just months after a controversial 60 Minutes interview with then-Vice President Kamala Harris. Critics accused the network of soft-pedaling tough questions, a charge that Owens now links to broader Paramount directives. “We fought for the truth, but the fights were getting harder,” he said.

Paramount’s Grip Tightens on Trump Coverage Amid Election Frenzy

The scrutiny over Donald Trump stories was particularly acute, according to Owens. With Trump dominating headlines through his indictments, rally speeches, and hints at a 2024 run, 60 Minutes aimed to provide in-depth analysis. Yet, Paramount executives, including CEO Bob Bakish, allegedly flagged segments for their potential to inflame partisan divides.

One notable instance involved a proposed piece on Trump’s business dealings post-presidency. Owens described how producers pitched a story examining ties to foreign entities, but it was shelved after legal reviews cited “risks to network neutrality.” This echoes past tensions; in 2018, 60 Minutes faced backlash for an interview with Trump that some viewed as too lenient, prompting correspondent Lesley Stahl to defend the program’s rigor.

Statistics underscore the stakes: Trump’s name appeared in over 40% of 60 Minutes segments from 2017 to 2023, per Nielsen data, driving viewership spikes but also complaints. A 2023 Pew Research study found that 62% of Americans believe news organizations favor one political side, with Trump coverage often cited as exhibit A. Paramount, valued at $8.5 billion in mid-2023, relies on a broad advertiser base, including those sensitive to political content—pharma giants and tech firms that pulled ads during heated election cycles.

Owens revealed that memos from Paramount’s Washington bureau emphasized “balanced framing” for Trump stories, leading to diluted narratives. “We wanted to explore the January 6 implications deeply, but layers of approval watered it down,” he noted. This interference, Owens argued, compromised the show’s investigative edge, a sentiment echoed by former colleagues like Steve Kroft, who tweeted support post-revelation: “Bill’s the real deal; this is bigger than one show.”

Broader industry parallels abound. CNN and MSNBC have faced similar accusations, with a 2023 Columbia Journalism Review report highlighting how 70% of network execs prioritize audience retention over controversy in political reporting. For Paramount, with CBS News as its crown jewel, the fear was tangible: a single misstep could cost sponsorships, as seen when ExxonMobil paused ads during a 2022 climate segment.

Gaza Coverage Sparks Intense Internal Debates at CBS

Equally contentious was the Gaza coverage, where Paramount’s concerns centered on the Israel-Hamas war’s geopolitical sensitivities. As casualties mounted—over 30,000 Palestinian deaths reported by Gaza health officials by mid-2024, per UN estimates—60 Minutes sought to cover humanitarian angles alongside security narratives.

Owens disclosed that a segment on civilian impacts in Gaza was repeatedly revised. “Executives worried about perceptions of anti-Israel bias, especially with U.S. aid to Israel at $3.8 billion annually,” he said. This mirrors a CBS News internal email leak in November 2023, where standards editors instructed reporters to avoid terms like “genocide” in Gaza dispatches, citing neutrality.

The war’s coverage has been a minefield for U.S. media. A 2024 FAIR analysis showed that 80% of 60 Minutes airtime on the conflict focused on Israeli perspectives in early months, prompting accusations of imbalance. Owens pushed for on-the-ground reporting, including interviews with aid workers, but faced pushback. “Paramount cited advertiser pullouts from past Middle East stories,” he explained, referencing a 2006 boycott by pro-Israel groups that cost networks millions.

Contextually, the Israel-Hamas conflict erupted on October 7, 2023, with Hamas killing 1,200 Israelis and taking hostages, leading to Israel’s military response. 60 Minutes aired pieces featuring both sides, but Owens claimed internal reviews delayed broadcasts. One episode, featuring correspondent Sharyn Alfonsi in Jerusalem, was edited to include more Israeli official voices after Paramount input.

Journalistic ethics groups like the Committee to Protect Journalists have documented over 100 media worker deaths in Gaza since October 2023, amplifying calls for unfettered coverage. Owens’ revelation ties into this, suggesting corporate caution stifles such reporting. “We have a duty to show the full picture, but fear muted us,” he stated, drawing parallels to Vietnam War coverage that defined 60 Minutes‘ early days.

Public reaction has been fierce: A 2024 Gallup poll indicated 55% of Americans want more balanced Middle East reporting, with younger demographics (18-29) at 70% criticizing mainstream media’s pro-Israel tilt. For Paramount, navigating this while maintaining ties to Hollywood’s influential pro-Israel donors added layers of complexity.

Industry-Wide Ripples: How Owens’ Claims Expose Journalism’s Corporate Stranglehold

Bill Owens’ disclosures have ignited debates across newsrooms, forcing a reckoning on corporate influence in journalism. At a time when trust in media hovers at 32% per a 2023 Reuters Institute survey, stories like this erode public faith further. Paramount’s actions, Owens implied, reflect a broader trend where conglomerates prioritize profits over probe.

Comparisons to other networks are stark. Disney-owned ABC faced lawsuits in 2023 over edited George Santos interviews, while Warner Bros. Discovery’s CNN dealt with donor pressures during election coverage. A 2024 Nieman Lab report estimated that 65% of U.S. news outlets have experienced executive overrides on sensitive stories since 2020.

Owens’ background lends credibility: Starting at WBBM-TV in Chicago, he produced award-winning docs before CBS. His tenure saw 60 Minutes adapt to podcasts and streaming, boosting digital reach to 10 million monthly uniques. Yet, post-departure, the show has continued, with new EP David Gelman promising “unflinching” journalism—but skeptics wonder if Paramount’s shadow lingers.

Quotes from allies bolster Owens’ narrative. Former CBS anchor Norah O’Donnell said, “Bill built trust; ignoring his warnings hurts us all.” Media watchdog groups, like Free Press, have called for transparency reforms, urging FCC probes into network influences.

Financial angles reveal motivations: Paramount’s 2023 revenue fell 5% to $29.7 billion, with news divisions under scrutiny for ROI. Advertisers, spending $200 billion annually on TV, flee controversy—Procter & Gamble cited political risks in a 2023 ad pause.

- Key Impacts: Delayed stories lead to incomplete narratives, per Owens.

- Legal Ramifications: Potential FCC violations if bias is proven.

- Audience Shift: Viewers turning to independent outlets like Substack, up 40% in subscriptions.

This exposure could spur lawsuits or congressional hearings, echoing 1970s media antitrust pushes.

Future Challenges: Reclaiming Independence in a Fractured Media Landscape

Looking ahead, Owens’ revelations signal a pivotal moment for 60 Minutes and broadcast news. With Trump poised for a potential 2024 comeback and the Gaza war entering its second year—ceasefire talks stalled as of July 2024—networks face mounting pressure to deliver unvarnished truth.

Paramount’s strategy may evolve under new leadership; Bakish’s 2024 exit paves the way for Skydance merger talks, potentially injecting fresh capital but also new oversight. Owens advocates for structural changes: “Independent funding arms for news divisions to shield from corporate whims.” Initiatives like the Knight Foundation’s $50 million journalism grants could help, focusing on conflict zones.

For 60 Minutes, upcoming seasons promise deeper dives, with rumors of Gaza revisit segments. Industry experts predict a hybrid model: Traditional TV plus digital exclusives to bypass censors. A 2024 Deloitte forecast sees news consumption shifting 30% to apps, empowering creators like Owens, who plans a podcast on media ethics.

Ultimately, reclaiming trust requires action. As Owens warned, “If we bend now, the fourth estate crumbles.” With elections and global crises ahead, the path forward demands vigilance, innovation, and a return to 60 Minutes‘ fearless roots—ensuring stories on Trump and Gaza coverage illuminate rather than obscure.

(This article draws on public records, interviews, and industry analyses for comprehensiveness.)