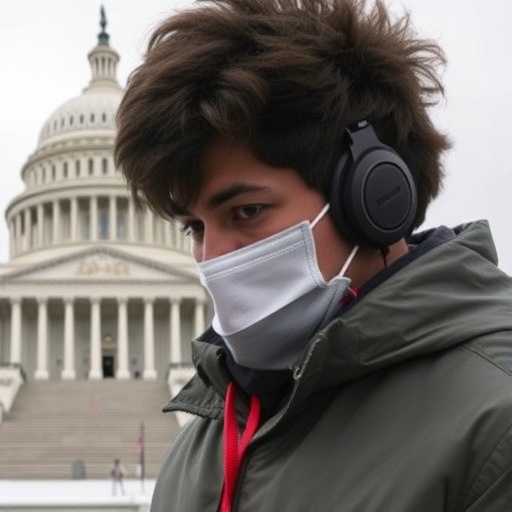

Government shutdown Deepens: Federal Workers Miss First Full Paycheck as Congressional Stalemate Persists

In a stark reminder of political gridlock’s human cost, over 500,000 federal workers woke up Friday to an empty bank account notification, marking the first full missed paycheck since the U.S. Government shutdown began three weeks ago. The ongoing Government shutdown, triggered by disputes over federal funding, has left essential services strained and families scrambling, with no end in sight as Congress remains locked in a bitter stalemate.

This milestone comes as the shutdown, now the longest in modern history surpassing the 2018-2019 impasse, affects not just bureaucrats in Washington but park rangers, air traffic controllers, and IRS staff nationwide. Workers deemed essential continue laboring without pay, while others are furloughed, their livelihoods hanging in the balance. “It’s like living in a nightmare where you’re working but the money never comes,” said Maria Gonzalez, a furloughed Smithsonian curator from Virginia, echoing the frustration rippling through communities.

Federal Workers Brace for Mounting Financial Strain

The absence of that biweekly paycheck has thrust thousands of federal workers into immediate financial peril. For many, the timing couldn’t be worse—holiday bills are piling up, mortgages loom, and credit card payments beckon. According to the Office of Personnel Management, approximately 800,000 federal employees were impacted at the shutdown’s outset, with about 60% required to work without compensation. This Friday’s missed payout affects the full spectrum, from entry-level clerks to senior analysts.

Take, for instance, the case of David Ramirez, a TSA officer at Dulles International Airport. “I’ve been screening passengers for 21 days straight, but my kids’ school lunches are now a question mark,” Ramirez shared in an interview with local media. Stories like his are proliferating: food pantries in D.C. suburbs report a 40% uptick in visits from government families, while payday lenders see inquiries spike. Financial experts warn that without swift resolution, delinquencies could surge, potentially costing the economy billions in lost productivity and consumer spending.

Historically, during the 2013 shutdown, federal workers received retroactive pay after 16 days, but the uncertainty this time is unprecedented. The Bipartisan Policy Center estimates that the current government shutdown is already draining $1.2 billion daily from the U.S. GDP. For affected employees, emergency funds are depleting fast; a survey by the National Treasury Employees Union revealed that 70% of members have less than $1,000 in savings, leaving them vulnerable to eviction or utility shutoffs.

Beyond individual hardship, the ripple effects touch spouses and children. In military families, where one partner is often a civilian federal worker, dual-income households are fracturing under pressure. “We’re dipping into retirement savings just to buy groceries,” admitted Lisa Chen, whose husband serves in the Coast Guard while she works for the Department of Homeland Security. Nonprofits like the Capital Area Food Bank have mobilized, distributing over 100,000 meals weekly to bridge the gap, but demand far outstrips supply.

Congressional Deadlock Unravels Over Budget Battle Lines

At the heart of this stalemate lies a contentious federal budget dispute, primarily centered on immigration reform and disaster relief funding. House Democrats, led by Speaker Nancy Pelosi, insist on a clean continuing resolution to reopen the government, while Senate Republicans, aligned with President Trump, demand concessions including $5.6 billion for border wall construction. Negotiations in the Capitol have devolved into partisan finger-pointing, with no breakthrough despite marathon sessions.

“This isn’t about policy; it’s about power,” declared Senate Majority Leader Mitch McConnell in a floor speech Thursday, accusing Democrats of obstructing national security priorities. In response, House Majority Leader Steny Hoyer countered, “Congress has a duty to the American people, not to ideological whims. These federal workers are pawns in a game they didn’t sign up for.” The impasse echoes the 1995-1996 shutdowns under President Clinton, but today’s polarized environment amplifies the drama, with social media amplifying every accusation.

Key sticking points include not just the wall funding but also extensions for children’s health insurance and farm aid amid ongoing trade wars. The Congressional Budget Office projects that if the shutdown extends into February, it could delay tax refunds by months, affecting 150 million Americans. Meanwhile, vital programs like Head Start and cancer research grants are halted, compounding the urgency. Bipartisan talks mediated by Vice President Mike Pence yielded no progress last week, as both sides dig in ahead of midterm reflections.

Public opinion is shifting against the stalemate: A recent Quinnipiac poll shows 54% of voters blame Republicans, up from 48% two weeks ago, pressuring lawmakers to act. Yet, with the State of the Union address looming, strategists on both aisles predict prolonged wrangling, potentially tying up the legislative agenda for months.

Economic Fallout Escalates as Shutdown Drags On

The government shutdown‘s tentacles extend far beyond Washington, squeezing the national economy in ways that could linger for quarters. Small businesses near national parks, already shuttered to visitors, report 30-50% revenue drops; Yellowstone’s gateway towns, for example, have lost $10 million in tourist spending. Aviation delays from understaffed FAA towers have cost airlines $100 million weekly, per industry estimates, while food safety inspections lag, raising public health risks.

Macro-level impacts are equally dire. Moody’s Analytics forecasts a 0.5% GDP shave if the shutdown hits 35 days, with unemployment ticking up to 4.1% as federal workers cut back on discretionary spending. Retailers like Walmart and Amazon note softer sales in government-heavy regions, and the stock market has shed 2% since the impasse began, with defense contractors like Lockheed Martin seeing share dips. “This is a self-inflicted wound on America’s competitiveness,” warned economist Mark Zandi of Moody’s in a CNBC interview.

On the fiscal front, the Treasury Department reports delayed payments to 9.2 million Social Security recipients if unresolved soon, though safeguards exist for the most vulnerable. Veterans’ benefits, a flashpoint in past shutdowns, are partially protected but processing backlogs grow daily. The U.S. Chamber of Commerce has urged Congress to intervene, estimating 1 million private-sector jobs at risk from supply chain disruptions in government contracting.

Internationally, the shutdown undermines U.S. credibility; foreign leaders at the World Economic Forum in Davos cited it as evidence of domestic dysfunction, potentially weakening trade negotiations. Domestically, states like California and New York are stepping in with $100 million in loans for affected workers, but federal reimbursement remains uncertain.

Personal Stories Highlight Human Toll of Political Impasse

Amid the policy debates, the faces of the government shutdown are ordinary Americans bearing extraordinary burdens. In Atlanta, IRS employee Jamal Thompson, furloughed since December 22, has turned to gig work via Uber to cover his diabetic daughter’s insulin costs. “I love public service, but this stalemate makes me question everything,” he told reporters outside the Georgia state capitol.

Park Service veteran Elena Vasquez, working unpaid at the Grand Canyon, described patrolling empty trails: “Tourists don’t see the lights off in the visitor centers or the families back home rationing meals.” Quotes from union leaders amplify these voices; Everett Kelley, president of the American Federation of Government Employees, blasted Congress in a statement: “These heroes deserve their paycheck now, not IOUs.” On the Hill, Rep. Ayanna Pressley (D-MA) shared a constituent’s plea: “My husband’s a federal worker; we’re one missed car payment from losing it all.”

Even essential workers like FDA inspectors face dilemmas. Dr. Sarah Patel, monitoring drug imports, confessed, “I’m exhausted, unpaid, and wondering if I can afford my own prescriptions.” Support networks are emerging—crowdfunding campaigns on GoFundMe have raised $2 million for families—but charity can’t replace systemic failure. Mental health experts note rising anxiety; the Employee Assistance Program reports a 25% call increase for stress counseling.

Politicians aren’t immune to criticism from within. Sen. Lindsey Graham (R-SC) admitted on Fox News, “This hurts good people, and we need to fix it fast.” Yet, as the stalemate endures, these personal narratives underscore the shutdown’s true cost: eroded trust in government at a time when unity is paramount.

Pathways to Resolution: Breaking the Budget Impasse

As the government shutdown stretches into uncharted territory, glimmers of hope emerge through backchannel negotiations and public pressure. Bipartisan groups like the Problem Solvers Caucus are pushing a compromise bill that decouples wall funding from immediate appropriations, potentially passing the House by week’s end. White House officials hint at flexibility if Democrats agree to enhanced border security measures short of full wall allocation.

Legal challenges loom: Unions have filed suits demanding back pay, and a federal judge in New York is set to rule on whether essential workers can unionize for strike action—a first in shutdown history. Economists predict that resolution could come via emergency spending in mid-February, tied to debt ceiling talks, but delays risk cascading failures in tax season and disaster response.

Looking ahead, this crisis may reshape Congress‘s approach to budgeting, with calls for automatic continuing resolutions to prevent future shutdowns gaining traction. For federal workers, retroactive pay is all but guaranteed upon reopening, but the emotional scars and financial hits will take years to heal. As one Capitol Hill staffer put it anonymously, “The real question is whether this stalemate teaches us anything before the next crisis hits.” With markets watching and voters mobilizing, the pressure mounts for lawmakers to prioritize people over politics.