New York Small Businesses Battle Beneficial Ownership Rule: A Paperwork Avalanche Threatens Local Entrepreneurs

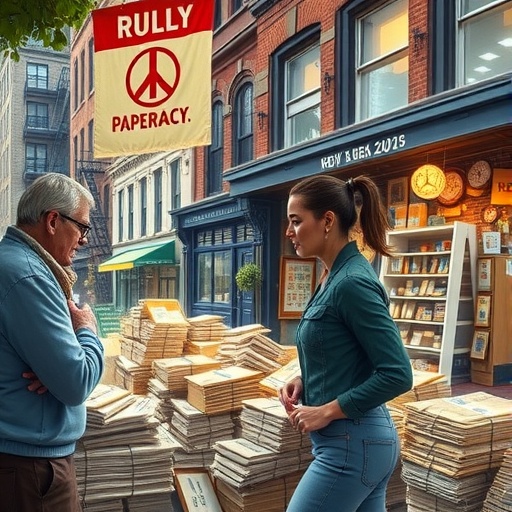

In the bustling streets of New York City and across the Empire State, a quiet revolution is brewing among small businesses. As of early 2024, a new Beneficial Ownership reporting requirement imposed by New York State has ignited fierce opposition, with entrepreneurs decrying it as a bureaucratic nightmare that could stifle growth and force closures. “This rule is like adding a mountain of paperwork to an already uphill battle,” says Maria Gonzalez, owner of a Brooklyn-based artisanal bakery, who estimates she’ll spend over 20 hours just complying with the initial filing. With thousands of small businesses now scrambling to disclose ownership details, the backlash is growing louder, threatening to reshape the state’s vibrant entrepreneurial landscape.

- Unpacking the Beneficial Ownership Mandate: What New York Businesses Must Now Report

- Small Business Owners’ Outrage: Stories of Regulatory Overreach in the Empire State

- Economic Ripples: How the Rule Could Derail New York’s Small Business Boom

- Coalition Builds: Advocacy Groups and Lawmakers Challenge the State’s Stance

- Future Stakes: Will New York Pivot to Protect Its Small Business Engine?

Unpacking the Beneficial Ownership Mandate: What New York Businesses Must Now Report

The Beneficial Ownership rule, stemming from federal guidelines under the Corporate Transparency Act but amplified by New York State regulations, mandates that most small businesses—specifically those structured as LLCs, corporations, or similar entities—report detailed information about their true owners. This includes names, birthdates, addresses, and even identification numbers like passports or driver’s licenses for anyone holding at least 25% ownership or substantial control. The goal, according to state officials, is to enhance transparency and combat money laundering, tax evasion, and illicit financing, aligning with national efforts led by the Financial Crimes Enforcement Network (FinCEN).

But for small businesses in New York State, the implementation feels anything but straightforward. Filings must be submitted electronically through a state portal, with initial reports due by January 1, 2025, for existing entities and within 90 days for new ones formed after that date. Exemptions are narrow, covering only large corporations, publicly traded companies, and certain nonprofits—leaving the vast majority of mom-and-pop shops, startups, and family-run operations in the crosshairs.

Statistics underscore the scale: New York State is home to over 2.1 million small businesses, employing nearly 50% of the private workforce, according to the U.S. Small Business Administration (SBA). A recent survey by the New York State Small Business Development Center (SBDC) reveals that 68% of respondents anticipate compliance costs exceeding $500 per business, with 22% projecting figures above $2,000 when factoring in legal and accounting fees. “It’s not just the form—it’s verifying information, updating records annually, and risking penalties up to $10,000 for non-compliance,” explains SBDC director Elena Vasquez.

This mandate builds on federal requirements but adds a state layer, requiring businesses to cross-reference filings with both FinCEN and New York State authorities. Critics argue it’s redundant, as the federal rule already covers most bases, yet New York State has tailored it to include stricter verification processes, ostensibly to plug local loopholes in real estate and construction sectors prone to shell company abuse.

Small Business Owners’ Outrage: Stories of Regulatory Overreach in the Empire State

From the vineyards of the Finger Lakes to the high-rises of Manhattan, small businesses are voicing their frustrations with the Beneficial Ownership rule. Take John Reilly, a 55-year-old plumber who runs Reilly Plumbing Services in Rochester. With just three employees, Reilly never imagined his modest operation would need to expose personal details to government databases. “I’ve paid taxes on time for 25 years, and now I have to hand over my Social Security number? This feels like an invasion of privacy,” Reilly told reporters during a recent protest outside the state capitol in Albany.

Reilly’s sentiment echoes across demographics. A coalition of over 500 small businesses, dubbed the New York Entrepreneurs Against Overregulation (NYEAO), has mobilized, collecting more than 10,000 petition signatures in the past month alone. Their grievances center on the paperwork burden: annual updates are required if ownership changes, and even minor adjustments—like adding a family member to the deed—trigger refiling. For immigrant-owned businesses, which make up 40% of New York State‘s small businesses per Census data, the rule exacerbates fears of data misuse amid ongoing immigration debates.

Women entrepreneurs are hit hard too. Sarah Kim, founder of a tech consulting firm in Queens, shared her ordeal: “As a single mother running a home-based business, I don’t have the bandwidth for this. The time spent on compliance is time away from clients and innovation.” Kim’s story highlights a broader trend; a 2023 report from the National Federation of Independent Business (NFIB) found that regulatory compliance costs small businesses an average of $12,000 annually, with paperwork eating up 15% of owners’ time.

Protests have escalated, with NYEAO staging rallies in key districts. At a Buffalo event last week, attendees waved signs reading “Stop the Ownership Inquisition!” and heard from Assemblyman David Weprin, who pledged to introduce a bill easing the rule’s requirements. “New York State should support small businesses, not suffocate them,” Weprin declared, drawing cheers from the crowd of over 200.

Economic Ripples: How the Rule Could Derail New York’s Small Business Boom

The Beneficial Ownership mandate isn’t just paperwork—it’s a potential economic detonator for New York State‘s small businesses. Economists warn that the added burdens could lead to a 5-7% uptick in closures within the first year, based on models from similar regulations in California and Illinois. The state’s small businesses contribute $1.2 trillion to the GDP annually, per the SBA, and any disruption could ripple through supply chains, from retail to hospitality.

Consider the numbers: Compliance with Beneficial Ownership reporting is estimated to cost New York State small businesses collectively between $50 million and $100 million in the first year, according to a study by the Manhattan Institute. This includes not only direct fees but also opportunity costs—hours lost that could generate revenue. For instance, a typical small business owner earning $75,000 annually values their time at about $36 per hour; multiply that by 20 hours of compliance work, and the hidden toll becomes clear.

Sector-specific impacts are stark. In real estate, where anonymous ownership has long been an issue, the rule aims to curb fraud but risks alienating investors. A report from the Real Estate Board of New York (REBNY) notes that 30% of small businesses in property management may delay expansions due to disclosure fears. Meanwhile, in the tech startup scene—vital to New York State‘s innovation economy—founders like those at WeWork-inspired co-ops worry about deterring venture capital wary of public ownership data.

Broader economic context amplifies the strain. Post-pandemic recovery has seen small businesses in New York State rebound with 15% job growth since 2021, but inflation and labor shortages already squeeze margins. “This rule comes at the worst time,” says NFIB economist Holly Wade. “It’s like kicking someone when they’re down—small businesses are the backbone of our communities, and this could fracture that support.”

Urban vs. rural divides add nuance. In upstate areas like Syracuse, where small businesses dominate manufacturing, 75% lack in-house legal support, per SBDC data, making compliance a herculean task. Downstate, high-rent pressures in NYC compound the issue, with 40% of small businesses operating on razor-thin profits.

Coalition Builds: Advocacy Groups and Lawmakers Challenge the State’s Stance

Momentum is building against the Beneficial Ownership rule as advocacy groups and lawmakers in New York State form unlikely alliances. The NYEAO has partnered with the Chamber of Commerce and the Urban League, creating a diverse front that spans industries and ethnicities. Their strategy includes lobbying trips to Albany, where they’ve met with key figures like Governor Kathy Hochul’s economic advisors.

Legislative pushback is underway. Senate Bill S. 4567, introduced in March 2024, seeks to exempt small businesses with under $1 million in revenue from full Beneficial Ownership disclosures, instead opting for simplified attestations. Co-sponsor Senator Liz Krueger argues, “Transparency is important, but proportionality is key. We can’t let federal overreach drown our local innovators.” If passed, it could shield up to 60% of affected entities, based on revenue distributions from state tax records.

Legal challenges are also emerging. A class-action lawsuit filed in federal court by a consortium of small businesses alleges the rule violates Fourth Amendment privacy rights and imposes undue burdens under the Administrative Procedure Act. Lead attorney Rachel Cohen, from the firm Cohen & Associates, states, “This isn’t just about forms—it’s about the chilling effect on entrepreneurship in New York State.” Early hearings are slated for summer 2024, potentially setting precedents for other states.

Support from national bodies bolsters the fight. The SBA has issued guidance urging New York State to provide free compliance workshops, while the U.S. Chamber of Commerce has penned an open letter to Governor Hochul, signed by 1,200 small businesses, calling for a moratorium. “We’ve seen this movie before—regulations meant to fix one problem create ten more,” the letter reads.

On the state side, defenders like Department of Financial Services Commissioner Adrienne Harris counter that the rule is essential for national security. “Beneficial Ownership transparency has already uncovered $2 billion in illicit funds nationwide,” Harris noted in a recent press briefing. Yet, even she acknowledged plans for a helpline and online tutorials to ease the transition for small businesses.

Future Stakes: Will New York Pivot to Protect Its Small Business Engine?

As the Beneficial Ownership debate rages, the path forward for New York State‘s small businesses hangs in the balance. If unaddressed, experts predict a wave of consolidations, where solo operators merge or shutter to avoid compliance, potentially costing 50,000 jobs statewide by 2026, per a Brookings Institution forecast. Conversely, reforms could unlock relief, allowing small businesses to focus on growth amid New York State‘s recovering economy.

Governor Hochul’s upcoming budget address in January 2025 may signal shifts, with whispers of funding for compliance aid—perhaps $10 million in grants for small businesses. Advocacy groups are pushing for broader exemptions and streamlined portals, drawing inspiration from Texas, where a lighter-touch approach reduced filing errors by 40%.

Ultimately, this fight underscores a timeless tension: balancing security with freedom. For small businesses like Gonzalez’s bakery or Reilly’s plumbing service, the rule’s legacy will depend on whether New York State listens to its entrepreneurial heartbeat. As one owner put it, “We’re not hiding—we’re just trying to survive.” The coming months will test if policymakers can find that equilibrium, ensuring the Empire State’s small businesses continue to thrive without the weight of unnecessary chains.