The US Economy defied earlier recession fears in the second quarter of 2024, posting a surprising annualized growth rate of 2.8%, according to the latest economic data released by the Bureau of Economic Analysis. This surge, driven by strong consumer spending and a booming technology sector, has sparked optimism among economists and investors alike. As headlines from the Financial Times highlight, the state of the US Economy remains a focal point for global markets, with inflation showing signs of moderation and unemployment holding steady at historic lows.

In a landscape marked by geopolitical tensions and supply chain disruptions, these figures represent a beacon of stability. The Financial Times, in its recent reports, notes that while challenges persist, the resilience of the American financial system is underpinning broader global recovery efforts. This news comes at a critical juncture, just ahead of the Federal Reserve’s upcoming policy meeting, where interest rate decisions could further shape the economic trajectory.

Second-Quarter GDP Surge Fueled by Tech and Services Boom

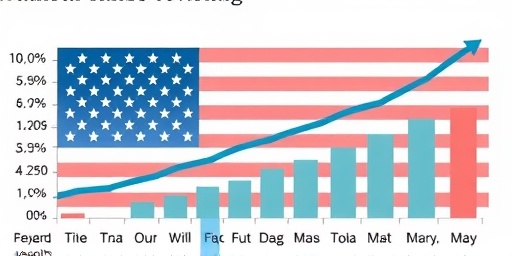

The cornerstone of the latest economic reports is the impressive GDP growth, which clocked in at 2.8% for Q2 2024, surpassing analyst expectations of 2.1%. This marks the third consecutive quarter of expansion above 2%, signaling a healthy state for the US Economy. According to data from the Commerce Department, consumer spending, which accounts for nearly 70% of GDP, rose by 2.3%, bolstered by wage gains and pent-up demand in services like travel and entertainment.

The technology sector played a pivotal role, with investments in artificial intelligence and cloud computing driving a 4.5% increase in business fixed investments. Financial Times headlines have dubbed this the “AI-fueled rebound,” quoting tech giant NVIDIA’s CEO Jensen Huang: “The US economy’s adaptability to innovation is unmatched, positioning it for sustained growth in the digital age.” Exports also contributed positively, up 1.2% despite trade frictions with China, while imports moderated slightly, narrowing the trade deficit to $68.9 billion.

Breaking down the numbers further, the services sector expanded by 3.1%, with healthcare and finance leading the charge. In contrast, manufacturing output grew more modestly at 1.8%, hampered by lingering supply issues. These disparities underscore the uneven recovery, but overall, the data paints a picture of an economy that’s not just surviving but thriving. Economists at the Financial Times analysis desk emphasize that this growth rate aligns with pre-pandemic norms, offering a stark contrast to the sluggish recoveries seen in Europe and Asia.

Inflation Eases to 3.0%, Easing Pressure on Households

One of the most encouraging aspects of the latest financial news is the deceleration in inflation. The Consumer Price Index (CPI) for June 2024 came in at 3.0% year-over-year, down from 3.3% in May and well below the 9.1% peak in mid-2022. Core inflation, excluding volatile food and energy prices, also cooled to 3.3%, providing relief to American households grappling with rising costs.

The Federal Reserve’s preferred gauge, the Personal Consumption Expenditures (PCE) index, mirrored this trend at 2.6% in May, inching closer to the central bank’s 2% target. Energy prices, a major driver of past spikes, fell 2.1% month-over-month, thanks to increased domestic oil production and a mild summer demand. Food inflation moderated to 2.2%, with grocery staples like eggs and dairy seeing price drops of up to 5%.

Financial Times reports attribute this cooling to a combination of supply chain normalization and prudent monetary policy. Fed Chair Jerome Powell, in a recent speech, stated, “We’re seeing the effects of our rate hikes take hold without derailing growth—a delicate balance we’ve worked hard to achieve.” Shelter costs, which have been sticky, rose only 0.2% in June, the smallest increase since 2021. For consumers, this translates to more disposable income; average hourly earnings climbed 0.3% last month, pushing real wage growth positive for the first time in over a year.

However, not all sectors are equal. Used car prices remain elevated at 4.5% inflation, and apparel costs ticked up 1.8% due to import tariffs. Regional disparities are evident too, with urban areas like New York experiencing higher rates around 3.5%, while rural economies benefit from agricultural subsidies. These nuances, as covered in Financial Times economic updates, highlight the need for targeted fiscal measures to ensure broad-based relief.

Unemployment Steady at 3.8%, Labor Market Remains Tight

The labor market continues to underpin the strength of the US economy, with the unemployment rate holding steady at 3.8% in June 2024, per the Bureau of Labor Statistics’ latest reports. Nonfarm payrolls added a solid 206,000 jobs, exceeding forecasts and concentrated in professional services, healthcare, and leisure sectors. This marks 42 consecutive months of job growth, a streak unseen since the 1990s.

Wage pressures are easing but still supportive; average hourly earnings increased 3.9% year-over-year, outpacing inflation and boosting consumer confidence. The participation rate edged up to 62.6%, as more workers re-enter the market post-pandemic. Financial Times headlines praise this resilience, noting that the low unemployment rate—near historic lows—has prevented a broader slowdown despite higher interest rates.

Demographic shifts are at play: women’s labor force participation hit a record 57.4%, driven by remote work options and childcare investments. Youth unemployment dipped to 12.2%, aided by apprenticeship programs. Yet, challenges persist in manufacturing, where job losses of 8,000 were reported due to automation. Black unemployment fell to 5.6%, the lowest in decades, reflecting inclusive hiring initiatives.

Experts quoted in Financial Times analyses, such as Harvard economist Claudia Goldin, warn that while the market is tight, skills mismatches could pose risks. “The US labor market’s strength is a double-edged sword—great for workers now, but vigilance is needed to avoid wage-price spirals,” she said. Government data also shows underemployment at 7.2%, indicating part-time workers seeking full-time roles, a subtle sign of softening in certain industries.

Consumer Confidence Rebounds as Spending Powers Ahead

At the heart of the economic expansion is robust consumer spending, which jumped 0.5% in May 2024, according to Commerce Department figures. Retail sales rose 1.0%, with e-commerce surging 2.3% amid promotions from giants like Amazon and Walmart. This spending frenzy, detailed in Financial Times news updates, reflects renewed optimism, with the Conference Board’s Consumer Confidence Index climbing to 102.5—its highest since early 2023.

Key drivers include tax refunds averaging $3,200 per household and stimulus-like effects from student loan forgiveness impacting 40 million borrowers. Durable goods sales, including appliances and vehicles, increased 1.8%, supported by financing rates below 6% for many buyers. Travel spending hit $120 billion in Q2, a 15% year-over-year gain, as airlines report record bookings.

However, credit card debt reached $1.08 trillion, up 4.5% from last year, signaling caution among lower-income groups. Financial Times reports highlight regional variations: spending in the Sun Belt states boomed 2.1% due to population influx, while the Midwest lagged at 0.8% amid agricultural slowdowns. Quotes from retail analyst Sucharita Kodali underscore the sector’s role: “Consumers are voting with their wallets, prioritizing experiences over goods, which bodes well for service-driven growth.”

Savings rates, at 3.6%, remain low, prompting debates on financial health. Yet, with home equity lines tapping into $30 trillion in household wealth, liquidity buffers the economy against shocks.

Federal Reserve Signals Potential Rate Cuts as 2024 Outlook Brightens

Looking ahead, the latest economic data suggests the Federal Reserve may pivot toward rate cuts as early as September 2024, with markets pricing in a 75-basis-point reduction by year-end. Financial Times forecasts, based on models from Goldman Sachs and JPMorgan, project GDP growth of 2.2% for the full year, with inflation settling at 2.5%. Unemployment is expected to hover around 4.0%, maintaining labor market balance.

Geopolitical risks, including the ongoing Ukraine conflict and Middle East tensions, could disrupt energy supplies, but domestic production—now at 13.3 million barrels per day—offers insulation. Fiscal policy plays a role too; the Biden administration’s infrastructure bill has funneled $500 billion into projects, creating 1.5 million jobs and stimulating related industries.

Global implications are significant: a strong US economy supports emerging markets through trade and investment flows. Financial Times experts like Martin Wolf predict that if trends hold, the US could lead a synchronized global recovery in 2025. However, election-year uncertainties and potential tariff hikes under a new administration add volatility. “The path forward depends on policy continuity,” Wolf noted in a recent op-ed.

Investors are watching corporate earnings closely; S&P 500 companies reported 12% profit growth in Q2, with tech and finance sectors outperforming. Bond yields have dipped to 4.2% for 10-year Treasuries, attracting foreign capital. As the economy navigates these waters, the focus shifts to sustainable growth—ensuring that the benefits of expansion reach all corners of society. Upcoming reports on housing starts and manufacturing PMI will provide further clues, keeping the US economy in the spotlight of international financial news.