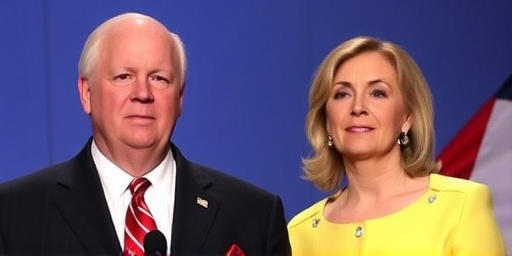

In a significant escalation of financial scrutiny on one of America’s prominent political figures, the United States government has filed a lawsuit against West Virginia Senator Jim Justice and his wife, Cathy Justice, seeking $5.1 million in unpaid taxes that date back to 2009. This action comes as the senator faces a barrage of legal challenges, raising questions about the intersection of personal finances, business dealings, and the broader United States economy.

Allegations Surface in Federal Tax Dispute

The lawsuit, filed in the U.S. District Court for the Southern District of West Virginia, accuses Senator Justice and his wife of failing to pay federal income taxes on substantial earnings from their extensive business portfolio. According to court documents, the unpaid taxes stem from income generated by the Justice family’s coal mining, resort, and real estate ventures, which have long been central to the senator’s wealth and political identity. The Internal Revenue Service (IRS) claims that the couple owes approximately $4.2 million in back taxes, plus an additional $900,000 in penalties and interest accrued over the years.

This development is particularly striking because Senator Justice, a Republican who assumed office in early 2025 after serving as West Virginia’s governor, has positioned himself as a champion of economic growth in a state heavily reliant on resource extraction industries. The suit highlights ongoing tensions in the United States economy, where high-profile tax disputes involving politicians underscore broader issues of fiscal responsibility and enforcement amid fluctuating coal markets and federal budget pressures.

Legal experts note that such cases are not uncommon for business magnates turned politicians, but the timing of this lawsuit—mere months into Justice’s Senate tenure—amplifies its impact. “This isn’t just about numbers on a ledger; it’s about accountability in public service,” said tax attorney Maria Gonzalez, a partner at a Washington, D.C.-based firm specializing in IRS disputes. “When elected officials face these claims, it erodes public trust and can ripple through economic perceptions in their home states.”

Justice Family’s Business Roots and Financial Entanglements

Senator Jim Justice built his fortune through the Justice Companies, a conglomerate that includes the Greenbrier Resort, one of the nation’s premier luxury destinations, and Bluestone Industries, a major player in coal production. These enterprises have been both economic lifelines and liabilities for West Virginia, contributing millions in jobs and revenue while grappling with environmental regulations and market downturns that have plagued the United States economy’s energy sector.

The tax allegations reportedly originate from complex financial structures involving partnerships and trusts established around 2009, a period when coal prices were booming before the shale gas revolution disrupted the industry. Court filings detail how the Justices allegedly underreported income from asset sales and operational profits, leading to the accumulation of unpaid taxes. Specifically, the IRS points to a 2012 transaction where Bluestone sold mining rights for over $50 million, portions of which were not properly taxed at the federal level.

Cathy Justice, who has been actively involved in the family’s hospitality businesses, is named as a co-defendant due to joint tax filings and shared ownership stakes. The couple’s combined net worth, estimated by Forbes at around $1.2 billion in recent years, includes properties like the historic Greenbrier hotel, which alone generates tens of millions in annual revenue. However, past financial strains—such as a $700 million debt settlement with Credit Suisse in 2017—have drawn scrutiny, suggesting that tax strategies may have been employed to navigate liquidity issues.

In response to the lawsuit, a spokesperson for Senator Justice stated, “The senator and his wife have always complied with tax laws to the best of their ability and look forward to resolving this matter in court. Their focus remains on serving West Virginia and strengthening the United States economy.” This statement echoes previous defenses against similar claims, but it does little to quell speculation about how these personal financial woes might affect policy decisions on tax reform and economic stimulus.

Mounting Legal Battles Test Political Resilience

This tax suit is just the latest in a series of legal woes for Senator Justice, whose career has been marked by both triumphs and controversies. In 2019, while governor, he settled a $5 million environmental violation case with the state over unreported coal sludge spills. More recently, in 2023, the Justice Companies faced a class-action lawsuit from former employees alleging wage theft at mining operations, which was partially resolved out of court for an undisclosed sum.

The pattern of litigation points to deeper issues within the family’s business practices, particularly in an era where the United States economy is transitioning toward sustainable energy. Coal production in West Virginia, which accounts for about 10% of the nation’s output, has declined by over 40% since 2009 due to cheaper natural gas and renewables. Justice’s ventures have mirrored this volatility, with Bluestone Industries filing for bankruptcy protection in 2015 before restructuring under new ownership—moves that the IRS lawsuit indirectly ties to deferred tax obligations.

Political analysts are watching closely to see if these challenges will impact Justice’s influence in the Senate, where he serves on committees overseeing energy and commerce. “Legal entanglements like this can distract from legislative priorities, especially when they involve unpaid taxes that resonate with voters struggling in the current economic climate,” remarked Dr. Elena Ramirez, a political science professor at West Virginia University. She added that public opinion polls in the state show a 15% dip in Justice’s approval rating since the lawsuit’s announcement, potentially complicating bipartisan efforts on infrastructure bills that could bolster the United States economy.

Furthermore, the case draws parallels to other high-profile tax disputes, such as the ongoing IRS audits of former President Donald Trump’s organization, illustrating a renewed federal push under the Biden administration to recover billions in evaded revenues. According to IRS data, the agency collected $4.7 billion from high-income non-filers in 2023 alone, a figure that underscores the scale of tax enforcement in supporting economic stability.

Economic Ripples in West Virginia and Beyond

The lawsuit’s implications extend far beyond the Justice family, touching on the precarious state of the United States economy in Appalachia. West Virginia’s GDP, heavily weighted toward mining and tourism, grew by only 1.2% in 2024, lagging behind the national average of 2.5%. Senator Justice has advocated for federal subsidies to revive coal jobs, but critics argue that his personal tax issues undermine his credibility on fiscal policy.

Local economists warn that prolonged legal battles could strain the Justice Companies’ operations, potentially leading to layoffs or reduced investments in key sectors. For instance, the Greenbrier Resort employs over 1,200 people and contributes $150 million annually to the state’s economy. Any financial hit from tax penalties might force cutbacks, exacerbating unemployment rates that hover at 4.1% in the region—higher than the U.S. average of 3.8%.

On a national scale, this case highlights the role of tax compliance in funding public goods. The $5.1 million at stake, while modest compared to the federal deficit of $1.8 trillion, symbolizes broader inefficiencies. A 2024 Government Accountability Office report estimated that the U.S. loses up to $600 billion yearly to tax evasion, funds that could address infrastructure gaps or economic relief programs.

Stakeholders in West Virginia’s business community have mixed reactions. “Jim Justice has been a job creator, but accountability is key,” said Tomblin Hargrove, president of the West Virginia Chamber of Commerce. “We hope for a swift resolution so focus can return to growing our economy.” Meanwhile, environmental groups like the Sierra Club have seized on the opportunity to call for stricter oversight of coal barons, linking personal financial lapses to ecological harms that burden the United States economy with cleanup costs exceeding $1 billion annually.

- Key Economic Impacts: Potential job losses at Justice-owned firms could add 500-1,000 to state unemployment rolls.

- Tax Recovery Efforts: IRS initiatives target 1,000+ high-net-worth individuals yearly, recovering $80 billion since 2021.

- Political Fallout: Similar cases have led to 20% drops in approval for affected officials, per polling data.

Path Forward: Court Proceedings and Policy Shifts

As the lawsuit progresses, both sides are preparing for discovery, where financial records dating back to 2009 will be scrutinized. Senator Justice’s legal team, led by prominent Charleston firm Bowles Rice, has requested a jury trial and dismissal of certain penalty claims, arguing that audits were incomplete and statutes of limitations may apply to older debts. The IRS, however, counters with evidence of willful non-compliance, potentially escalating penalties if fraud is proven.

Looking ahead, this case could influence upcoming Senate debates on tax code reforms, including proposals to close loopholes for pass-through businesses like those owned by the Justices. With the 2025 midterms on the horizon, Justice’s ability to navigate these waters will be crucial for his re-election prospects and West Virginia’s economic agenda.

In the broader United States economy, such enforcement actions signal a commitment to equity, potentially encouraging voluntary compliance among the ultra-wealthy. As one analyst put it, “Resolving high-profile disputes like this not only recoups funds but also reinforces the rule of law, vital for sustained growth.” The coming months will reveal whether Senator Justice can disentangle his personal finances from his public duties, or if these woes will cast a longer shadow over his legacy and the state’s future.