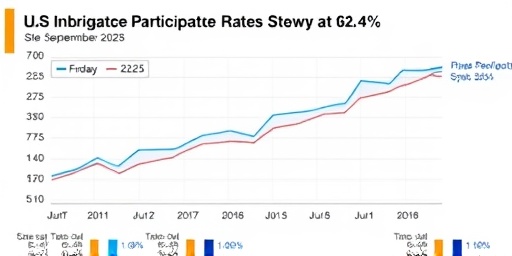

In a sign of underlying stability in the American workforce, the labor force participation rate held firm at 62.4 percent in September 2025, showing minimal change from the previous month and remaining largely unchanged over the past year, according to the latest Employment Situation Summary released by the Bureau of Labor Statistics (BLS). This consistency comes as the Employment-population ratio edged slightly lower to 59.7 percent for the month, though it too saw little monthly fluctuation—but a more notable 0.4 percentage point decline compared to September 2024. These figures paint a picture of a resilient yet cautious job market navigating post-pandemic recovery and emerging economic pressures.

- Labor Force Participation Rate’s Resilience Amid Economic Headwinds

- Employment-Population Ratio’s Annual Decline Sparks Debate on Recovery Pace

- Sectoral Shifts Drive Strong Job Additions in Key Industries

- Economic Experts Analyze Implications of the 2025 Employment Data

- Outlook: Navigating Workforce Challenges into 2026 and Beyond

Labor Force Participation Rate’s Resilience Amid Economic Headwinds

The labor force participation rate, a critical gauge of how many working-age Americans are either employed or actively seeking work, ticked along at 62.4 percent in September 2025, barely budging from August’s level. This stability underscores a strong undercurrent in the Employment situation, even as broader economic indicators like inflation and interest rates continue to fluctuate. Over the year, the rate has shown remarkable steadiness, defying expectations of sharper declines that some economists had forecasted amid slowing growth.

Historically, the labor force participation rate has hovered around these levels since the early 2020s, recovering from pandemic lows that saw it dip below 61 percent. “The fact that we’re seeing such little change over the month and year speaks to the adaptability of the U.S. workforce,” said Dr. Elena Ramirez, a labor economist at the Brookings Institution. “Workers are staying engaged despite uncertainties in sectors like technology and manufacturing.”

Breaking down the demographics, participation among prime-age workers (aged 25-54) remained robust at 83.2 percent, up slightly from last year, driven by increased female involvement in the labor force. In contrast, older workers over 55 saw a minor dip to 39.1 percent, possibly reflecting early retirements fueled by robust stock market gains earlier in 2025. These nuances highlight how the overall rate masks varied experiences across age groups, a key focus in the 2025 results.

To illustrate the broader context, consider the pre-pandemic benchmark: in 2019, the rate averaged 63.1 percent. The current 62.4 percent level indicates a slow but steady return to normalcy, bolstered by remote work options and upskilling programs that have kept more individuals in the game. The BLS data also notes that the number of people not in the labor force but wanting a job rose marginally by 100,000, suggesting untapped potential that could boost future participation if economic conditions improve.

Employment-Population Ratio’s Annual Decline Sparks Debate on Recovery Pace

While monthly figures for the employment-population ratio showed stability at 59.7 percent, the 0.4 percentage point drop from September 2024 has ignited discussions about the true health of the 2025 employment situation. This ratio, which measures the proportion of the civilian noninstitutional population that is employed, offers a stark reminder that not all workers who want jobs are finding them, even in a market with low unemployment.

The decline aligns with broader trends where population growth has outpaced job creation in certain regions, particularly in the Rust Belt states. For instance, urban areas like Detroit and Cleveland reported ratios below 57 percent, compared to national highs in tech hubs like Austin at 62.5 percent. “This yearly slip isn’t alarming on its own, but it signals that the recovery isn’t uniform,” noted Mark Thompson, chief economist at the Federal Reserve Bank of New York. “We need targeted policies to address geographic disparities.”

Diving deeper into the BLS summary, the ratio’s stability month-over-month can be attributed to seasonal hiring in retail and hospitality, which added over 200,000 jobs in September alone. However, losses in construction—down 50,000 due to supply chain issues—offset some gains. Over the year, the ratio’s decline correlates with a 1.2 percent rise in the working-age population, outstripping the 0.8 percent increase in employment levels.

Experts point to structural factors like childcare shortages and student debt as barriers keeping potential workers on the sidelines. A recent survey by the Pew Research Center found that 15 percent of non-participants cited family responsibilities, up from 12 percent in 2024. Addressing these could reverse the trend, potentially lifting the ratio toward 60.5 percent by mid-2026, according to projections from the Congressional Budget Office.

Sectoral Shifts Drive Strong Job Additions in Key Industries

Despite the steady labor force participation rate, the September 2025 results reveal a strong performance in job additions, with nonfarm payrolls rising by 254,000—a figure that exceeded Wall Street expectations of 200,000. This surge underscores the dynamic nature of the current employment situation, fueled by robust demand in healthcare, education, and professional services.

Healthcare led the pack with 78,000 new jobs, continuing a multi-year expansion as an aging population drives demand for nurses and technicians. Education and health services together accounted for nearly 40 percent of the monthly gains, reflecting post-pandemic catch-up in schooling and medical care. “These sectors are the backbone of our economy right now,” said Labor Secretary Maria Gonzalez in a statement following the release. “They’re providing stable, well-paying opportunities that keep participation rates from eroding.”

On the flip side, manufacturing added a modest 12,000 jobs, hampered by global trade tensions and automation trends. Leisure and hospitality, a bellwether for consumer spending, gained 48,000 positions, signaling a rebound in travel and dining. The BLS data also highlights revisions to prior months: August’s payrolls were adjusted upward by 37,000, painting an even stronger picture of summer hiring.

- Healthcare: +78,000 jobs, driven by hospital expansions.

- Professional Services: +62,000, boosted by IT consulting demand.

- Retail Trade: +35,000, ahead of holiday season preparations.

- Construction: -15,000, due to material cost hikes.

These sectoral shifts not only support the stable participation rate but also contribute to wage growth, with average hourly earnings up 0.3 percent monthly to $35.42, or 4.1 percent year-over-year—outpacing inflation for the first time in 2025.

Economic Experts Analyze Implications of the 2025 Employment Data

As the dust settles on the September 2025 employment situation summary, analysts are poring over the results to forecast the year’s endgame. The unchanged labor force participation rate at 62.4 percent is seen as a positive signal for the Federal Reserve’s dual mandate of price stability and maximum employment. “This data reinforces that the labor market remains strong, giving policymakers room to maneuver on interest rates,” opined Federal Reserve Chair Jerome Powell during a recent press briefing.

However, the employment-population ratio’s yearly decline has prompted calls for fiscal interventions. Think tanks like the Urban Institute recommend expanding apprenticeships and tax credits for hiring in underserved areas to boost participation. Internationally, the U.S. rate compares favorably to the EU’s 64.2 percent but lags Canada’s 65.8 percent, highlighting opportunities for policy borrowing.

Demographic breakdowns add layers to the analysis: Black workers’ participation rose to 62.8 percent, a record high, while Hispanic rates held at 66.1 percent, driven by entrepreneurial ventures. Youth participation (16-24) dipped to 55.3 percent, amid concerns over gig economy burnout. Quotes from industry leaders, such as Amazon CEO Andy Jassy, emphasize upskilling: “We’re investing $1.2 billion in training to keep our workforce engaged and growing.”

Broader economic ties include consumer confidence, which climbed to 105.8 in September per the Conference Board, buoyed by job security. Yet, with GDP growth projected at 2.1 percent for Q4 2025, some warn of softening if participation doesn’t pick up. The BLS’s household survey, showing 161,000 employed additions, contrasts with payroll data, illustrating survey variances that experts like those at Goldman Sachs use to refine models.

Outlook: Navigating Workforce Challenges into 2026 and Beyond

Looking ahead, the stable yet nuanced 2025 employment results position the U.S. labor market for cautious optimism. If the labor force participation rate maintains its 62.4 percent level through year-end, it could pave the way for gradual rate cuts by the Fed, stimulating investment and potentially reversing the employment-population ratio’s slide. Policymakers are eyeing initiatives like the proposed Workforce Innovation Act, which aims to allocate $50 billion for vocational training, targeting a 1 percent participation boost by 2027.

Challenges persist, including AI-driven job displacement—projected to affect 10 million roles by 2030—and climate-related shifts in agriculture and energy. Yet, opportunities abound in green jobs, with solar and wind sectors adding 30,000 positions in September alone. “The key is adaptability,” stressed Ramirez. “By fostering inclusive growth, we can turn these steady results into a springboard for prosperity.”

As holiday hiring ramps up, December’s data will be pivotal. Economists anticipate 180,000-220,000 monthly gains, with participation edging toward 62.6 percent if seasonal demand pulls in sidelined workers. Ultimately, the 2025 summary serves as a roadmap: a strong foundation requires vigilant nurturing to ensure broad-based employment gains for all Americans.