Americans Face Stark Warning on Emerging K-Shaped Economic Divide

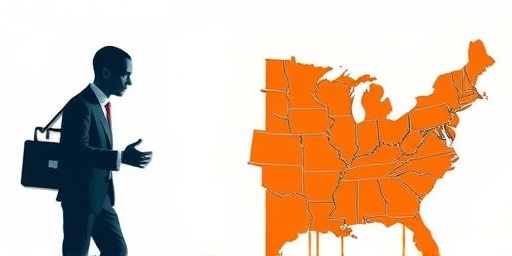

In a development that’s sending ripples through financial circles, Americans are being warned about a new type of economy that’s quietly reshaping the nation’s landscape. According to insights from Newsweek, this K-shaped recovery is spelling trouble for overall stability, as the upper echelons of society surge ahead while lower-income households plummet further into hardship. U.S. news reporter insights highlight how this bifurcation could exacerbate social tensions and hinder broad-based growth, urging immediate attention from policymakers and citizens alike.

- Americans Face Stark Warning on Emerging K-Shaped Economic Divide

- Upper-Income Surge Fuels Stock Market Boom Amid Broader Stagnation

- Lower-Income Households Grapple with Persistent Job Losses and Rising Costs

- Newsweek Reporters Spotlight Expert Views on Imminent Stability Risks

- Government Responses and Policy Debates Intensify Amid Economic Warnings

- Future Outlook: Navigating the K-Shaped Economy Toward Inclusive Growth

The term ‘K-shaped’ refers to an economic trajectory that diverges sharply, much like the letter K: one upward arm representing booming sectors and affluent groups, and a downward arm symbolizing stagnation or decline for the rest. Many experts, including those cited in recent Newsweek reports, argue that this isn’t just a temporary post-pandemic quirk but a structural shift that’s been brewing for years. With inflation biting into everyday expenses and job markets favoring skilled workers, the divide is becoming impossible to ignore.

As one Newsweek news reporter noted in a recent piece, ‘The K-shaped economy spells trouble not just for individuals but for the fabric of American society.’ This warning comes amid data showing that while stock markets hit record highs, wage growth for low earners lags far behind, leaving many Americans struggling to keep up.

Upper-Income Surge Fuels Stock Market Boom Amid Broader Stagnation

The upward arm of the K is vividly illustrated by the performance of high-income brackets and tech-driven industries. Since the onset of the COVID-19 recovery in 2021, the S&P 500 index has climbed over 80%, largely benefiting investors and executives in finance, technology, and real estate. Wealthy Americans, who hold the majority of stocks, have seen their net worth balloon, with the top 1% capturing nearly 40% of all corporate profits in recent quarters, according to Federal Reserve data.

For instance, companies like Amazon and Apple have reported explosive growth, with revenues soaring by double digits even as consumer spending in non-essential categories remains uneven. This has translated into windfall gains for upper-echelon professionals—think software engineers and corporate leaders—who’ve enjoyed remote work flexibility and bonuses. Newsweek’s coverage emphasizes how this segment’s spending on luxury goods and investments has propped up GDP figures, masking deeper issues.

Yet, this prosperity is concentrated. A report from the Brookings Institution reveals that households earning over $150,000 annually have recovered to pre-pandemic income levels and beyond, with savings rates climbing to 15% in some cases. In contrast, the bottom 50% of earners are still reeling, with many dipping into savings just to cover basics. This disparity, many economists warn, is a hallmark of the K-shaped economy that’s spelling trouble for equitable recovery.

Lower-Income Households Grapple with Persistent Job Losses and Rising Costs

On the downward trajectory, lower-income Americans are facing a perfect storm of challenges. Sectors like hospitality, retail, and manufacturing—employers of millions in blue-collar roles—have seen prolonged recovery delays. Unemployment rates for those without college degrees hover around 6%, double the national average, per U.S. Bureau of Labor Statistics figures from mid-2023.

Inflation has compounded the pain, with food and housing costs rising 20% and 15% respectively since 2020, outpacing wage increases for low-wage workers. Newsweek news reporters have spotlighted stories of families in Rust Belt states and urban centers where evictions are spiking and food insecurity affects 1 in 8 households. ‘This type of economy is leaving behind the very people who kept essential services running during the crisis,’ one expert quoted in Newsweek remarked.

Moreover, access to opportunities remains uneven. Remote work, a boon for white-collar jobs, is inaccessible to many service workers, leading to higher exposure to health risks and burnout. Studies from the Economic Policy Institute show that Black and Hispanic communities, disproportionately represented in lower-income brackets, have seen employment gains lag by up to 30% compared to white counterparts. This racial and class divide within the K-shaped framework is not just economic but social, potentially fueling unrest.

- Key Statistics on Lower-Income Struggles:

- Median wages for the bottom quartile grew only 2.5% annually since 2021, versus 5% for the top quartile (Pew Research).

- Over 10 million Americans remain in part-time jobs despite wanting full-time work (BLS data).

- Housing affordability has worsened, with rent burdens exceeding 30% of income for 40% of low earners (Harvard Joint Center for Housing Studies).

Newsweek Reporters Spotlight Expert Views on Imminent Stability Risks

Drawing from in-depth interviews, Newsweek has become a key voice in warning Americans about the perils of this K-shaped economy. U.S. news reporters there have consulted economists like Joseph Stiglitz and Heather Boushey, who argue that unchecked inequality could spell trouble for consumer-driven growth. Stiglitz, in a recent Newsweek op-ed, stated, ‘When the bottom half of the population can’t spend, the entire economy stalls— this type of bifurcation is a recipe for recession.’

Many analysts point to historical parallels, such as the Gilded Age or the lead-up to the 2008 financial crisis, where wealth concentration preceded broader downturns. Current indicators include declining consumer confidence among middle- and lower-income groups, as measured by the University of Michigan’s index, which dipped to 60 in late 2023 from pandemic lows but remains fragile.

Furthermore, fiscal policies like stimulus checks provided temporary relief, but their expiration has left a void. Newsweek’s reporting underscores how tax breaks favoring the wealthy—such as capital gains reductions—have accelerated the K-shape, with the richest 10% now holding 70% of total wealth, up from 60% a decade ago (Federal Reserve).

Experts warn of secondary effects: increased debt loads, with credit card balances hitting $1 trillion nationally, and potential spikes in mental health issues tied to financial stress. ‘Americans need to be warned now, before this spells irreversible trouble,’ echoed a panel of economists in a Newsweek forum.

Government Responses and Policy Debates Intensify Amid Economic Warnings

In response to these trends, the Biden administration has pushed initiatives like the Inflation Reduction Act, aiming to cap drug prices and invest in green jobs to lift lower-income sectors. However, critics argue these measures fall short, with only 20% of funds reaching underserved communities so far, per Government Accountability Office audits.

Congressional debates rage on, with proposals for a minimum wage hike to $15 and expanded child tax credits gaining traction among Democrats. Republicans, meanwhile, advocate for deregulation to spur business growth across the board. Newsweek news coverage has tracked these divides, noting how partisan gridlock could prolong the K-shaped malaise.

At the state level, actions vary: California’s universal basic income pilots have shown promise in stabilizing low-income families, reducing poverty by 10% in trial groups (Stanford study). Yet, in red states like Texas, tax cuts for businesses have boosted upper-tier jobs but done little for service workers.

- Proposed Policy Fixes:

- Universal healthcare expansion to cut medical debt burdens.

- Investments in vocational training for displaced workers.

- Progressive taxation reforms to redistribute gains from the economic upswing.

Future Outlook: Navigating the K-Shaped Economy Toward Inclusive Growth

Looking ahead, the trajectory of this K-shaped economy will hinge on adaptive strategies. If unaddressed, experts predict a drag on GDP growth to below 2% annually by 2025, per IMF forecasts, as consumer spending—70% of U.S. economic activity—falters among the majority. Socially, rising inequality could manifest in protests or electoral shifts, echoing the populism of recent years.

Optimistically, technological advancements like AI could create middle-skill jobs if paired with reskilling programs. Newsweek reporters suggest that bridging the divide requires bipartisan commitment, perhaps through infrastructure bills that employ millions in balanced ways. For everyday Americans, financial literacy and community support networks offer personal buffers.

Ultimately, heeding these warnings could steer the nation toward a more V-shaped or even recovery, fostering stability. As one economist put it in Newsweek, ‘This type of economy spells trouble only if we let it—proactive steps now can rewrite the story for all Americans.’