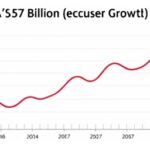

Nvidia Posts Historic $57 Billion Revenue, Driven by AI Chip Demand

In a blockbuster earnings report that has sent shockwaves through the tech world, Nvidia announced record quarterly sales of $57 billion, surpassing Wall Street expectations and underscoring the explosive growth in artificial intelligence (AI) technologies. The semiconductor giant’s fiscal fourth-quarter results, released after market close on Wednesday, revealed a staggering 126% year-over-year increase in revenue, propelled by unrelenting demand for its high-performance GPUs essential for AI training and data centers. CEO Jensen Huang hailed the figures as a testament to the ‘transformative power of AI,’ noting that data center revenue alone soared to $47.5 billion, accounting for over 83% of total sales.

This performance marks Nvidia‘s eighth consecutive quarter of triple-digit growth in its data center segment, a direct beneficiary of the global AI boom. The company’s net income also jumped 765% to $18.2 billion, reflecting not just volume sales but also premium pricing on its cutting-edge chips like the H100 and upcoming Blackwell series. Investors reacted swiftly, with Nvidia’s stock climbing 8% in after-hours trading, pushing its market capitalization above $3 trillion and solidifying its position as one of the most valuable companies in the world.

Huang, during the earnings call, emphasized the role of partnerships with major cloud providers like Amazon Web Services, Microsoft Azure, and Google Cloud, which are ramping up AI infrastructure investments. ‘We’re at the beginning of a multi-trillion-dollar AI industry,’ Huang stated, pointing to sovereign AI initiatives in countries like Japan and the UAE as new growth frontiers. These developments come amid a broader surge in semiconductor demand, where Nvidia’s dominance in AI accelerators has left competitors like AMD and Intel scrambling to catch up.

Boosting the US Economy Through Semiconductor Innovation

Nvidia’s meteoric rise is not just a corporate success story; it’s injecting vitality into the US economy at a critical juncture. The company’s record sales are estimated to contribute significantly to the nation’s gross domestic product (GDP), with economists at Goldman Sachs projecting that the AI sector, led by Nvidia, could add up to 1.5% to US GDP growth in 2024 alone. This infusion comes as the Federal Reserve grapples with moderating inflation and potential interest rate cuts, providing a much-needed tailwind for economic expansion.

Job creation is another bright spot. Nvidia’s expansion has spurred thousands of high-paying positions in engineering, software development, and manufacturing across states like California, Texas, and Oregon. The company’s recent $500 million investment in a new AI research hub in Santa Clara is expected to create over 1,000 jobs, while its supply chain ripples through suppliers such as TSMC in Taiwan and domestic firms like Applied Materials. According to a report from the Semiconductor Industry Association, the US chip sector supported 300,000 direct jobs in 2023, with Nvidia’s growth accelerating this trend and enhancing national security by reducing reliance on foreign semiconductor production.

Moreover, Nvidia’s success is bolstering the broader US economy by attracting foreign investment. The CHIPS Act, a $52 billion federal initiative signed into law in 2022, has funneled subsidies to companies like Nvidia to onshore manufacturing. As a result, construction of new fabs (semiconductor fabrication plants) is underway, promising to revitalize Rust Belt regions and create a more resilient supply chain. Economists note that every dollar spent on semiconductors generates $2.50 in downstream economic activity, from automotive to healthcare applications, underscoring Nvidia’s multiplier effect on growth.

Consumer benefits are emerging too, as AI advancements powered by Nvidia’s chips lead to innovations in everyday tech. From faster electric vehicles with Nvidia’s DRIVE platform to more efficient smart homes, the economic impact extends beyond Wall Street, fostering productivity gains that could help offset rising labor costs in a tight job market.

Easing Immediate Concerns Over the AI Bubble

While Nvidia’s robust earnings have quelled some anxieties about an impending AI bubble, the debate rages on among market watchers. The term ‘AI bubble’ has been bandied about since ChatGPT’s 2022 debut, evoking memories of the dot-com crash when hype outpaced profitability. Nvidia’s $57 billion sales figure, however, offers tangible evidence that AI is more than vaporware—it’s a revenue-generating powerhouse. Analysts at Morgan Stanley argue that the company’s 94% gross margins demonstrate sustainable demand, not speculative froth, with enterprise spending on AI projected to reach $200 billion annually by 2025.

Key to this reassurance is the diversification of AI applications. Beyond generative AI tools like those from OpenAI, Nvidia’s semiconductors are powering drug discovery at companies like Pfizer, climate modeling for governments, and autonomous systems in logistics. A recent survey by McKinsey found that 70% of Fortune 500 companies are investing in AI, with Nvidia as the go-to provider, suggesting broad-based adoption rather than niche enthusiasm. This has eased fears that the sector’s $1 trillion valuation is built on sand, especially as Nvidia’s order backlog swelled to $26 billion, indicating strong future pipelines.

Yet, not all views are rosy. Skeptics point to valuation metrics: Nvidia trades at 70 times forward earnings, a premium that assumes perpetual growth. Venture capitalist Marc Andreessen tweeted post-earnings, ‘Nvidia’s numbers are impressive, but the AI bubble won’t burst until real-world ROI disappoints.’ Still, for now, the sales surge acts as a buffer, convincing investors that the US economy’s AI-driven expansion has legs, potentially averting a sharp correction in tech stocks.

Analyst Warnings Highlight Banking Risks from AI Overinvestment

Despite the optimism, Nvidia’s success is igniting fresh concerns about banking risk in the financial system. Heavy AI investments by tech giants and financial institutions could strain bank balance sheets if returns on these outlays lag behind expectations. JPMorgan Chase analysts warn that banks financing $100 billion-plus in AI infrastructure loans face heightened default risks, particularly if economic slowdowns curb corporate profits. ‘The AI bubble, if it pops, could mirror the 2008 subprime crisis but in tech debt,’ said one report, estimating that US banks hold $300 billion in exposure to AI-related lending.

This banking risk stems from the capital-intensive nature of AI deployment. Companies like Microsoft and Meta are committing tens of billions to data centers equipped with Nvidia’s semiconductors, often funded through low-interest loans amid the post-pandemic easy money era. If AI fails to deliver outsized profits—say, due to regulatory hurdles or energy shortages—overleveraged firms could default, triggering a chain reaction. The Bank of International Settlements has flagged this as a systemic vulnerability, noting that non-bank lenders like venture debt providers are amplifying the exposure.

Quotes from industry leaders underscore the tension. BlackRock CEO Larry Fink cautioned in a recent interview, ‘AI is the future, but banks must stress-test their portfolios against bubble scenarios.’ Regulators are responding: The Federal Reserve announced plans for enhanced AI risk assessments in bank exams, while the SEC is scrutinizing disclosures from AI-heavy firms. For semiconductors like Nvidia’s, this means potential volatility if funding dries up, though the company’s cash reserves of $31 billion provide a buffer.

Mitigating factors include diversified banking portfolios and rising interest rates that could temper excessive borrowing. Still, with AI capex forecasted at $1 trillion over the next five years, the banking risk looms large, prompting calls for prudent investment strategies to safeguard the US economy’s tech-fueled momentum.

Looking ahead, Nvidia’s trajectory will be pivotal. The company teased next-generation Blackwell chips capable of 30x faster AI inference, which could sustain demand and further integrate AI into economic fabric. Upcoming earnings from peers like TSMC and AMD will offer clues on semiconductor health, while Fed policy decisions could influence banking risk dynamics. As the AI revolution unfolds, balancing innovation with financial stability remains key to ensuring Nvidia’s record sales translate into enduring prosperity for the US economy.